The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

Nov. 26 2019, Updated 9:15 p.m. ET

Default risk is the risk for the possibility that a bond issuer will be unable to make interest or principal payments when they are due. If these payments are not made in time as per the agreement in the bond documentation, the issuer is considered to be in default. For example, if an asset class had 100 individual issuers and two of them defaulted in the prior 12 months, the default rate would be 2%. The default rate can also be “dollar-weighted,” meaning it measures the dollar value of defaults as a percentage of the overall market.

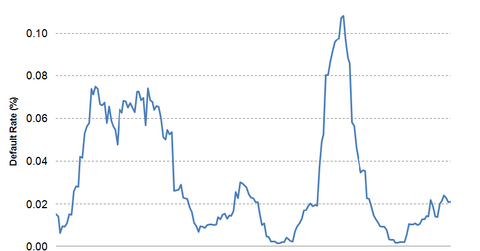

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations. During the recent crisis of 2008, the default risk on high yield bonds went up. This essentially means that the probability of these issuers defaulting on the interest rate and principal payment was much higher than usual.

In contrast, when the economy recovers, default rate declines. This is because the fundamentals on the company issuing high yield bonds get better. When default rates increase, it implies that loans are riskier in general, and so, investors will start to demand higher yields for taking on the risk of lending money. When yields go up, prices decrease. This is why default rate and bond price have negative relation.

Generally speaking, companies and persons with high default risk stand a greater chance of a loan being denied and pay a higher interest rate on the loans. This may cause a temporary liquidity risk in the market or may lead to a more long-term systemic risk as was observed in the recent credit market crisis in 2008.