Why oil takeaway capacity in the Bakken can affect earnings

The availability of takeaway capacity from the Bakken can affect producers’ earnings.

May 4 2021, Updated 10:30 a.m. ET

Takeaway capacity

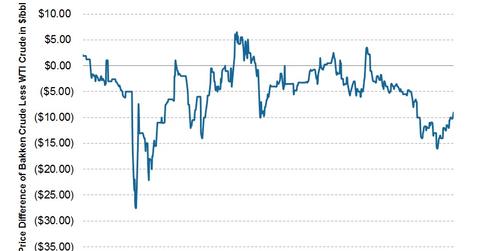

Oil production in the Bakken has grown so rapidly that getting oil out of the area has been an issue. The ability to get oil out of the area via vehicles like pipelines, trucks, and rails is called “takeaway capacity.” The availability and cost of takeaway capacity can affect the revenues that Bakken producers realize. As oil production in the area grew, pipeline capacity to take crude out of the region to major oil hubs or refineries quickly filled up. Since early 2012, the price between Bakken crude and WTI (West Texas Intermediate, the benchmark U.S. crude) fluctuated due to limitations in takeaway capacity. Bakken crude traded as much as $28 per barrel under WTI in early 2012 as new production overwhelmed existing takeaway capacity.

The wide Bakken differential cut into the revenues of producers in the region. For instance, in 1Q12, WTI crude traded at an average price of ~$103 per barrel. Meanwhile, the average price Continental Resources (CLR), the largest producer in the area, received on its crude oil production was $90.58 per barrel, about $12 per barrel below WTI. During that time, Oasis Petroleum (OAS), another Bakken producer, received an average price per barrel of $88.10 for its crude production.

Since 1Q12, new takeaway capacity became available largely in the form of rail transportation. While pipelines are the most economical way to transport crude oil, they are expensive to build, have a longer lead time, and also have more regulatory concerns. As production grew, companies utilized more rail and oil exported by rail from North Dakota grew from less than 100,000 barrels per day in mid-2011 to approximately 750,000 barrels per day currently (source: North Dakota Pipeline Authority).

The new rail capacity took Bakken crude from North Dakota to markets like East Coast and West Coast refiners, who had traditionally imported waterborne international crude, which has for some time traded at a price premium to WTI. Even though rail transport to the East and West Coasts costs upwards of $9 per barrel, refiners still found Bakken crude plus the cost of transportation ultimately cheaper than Brent crude. The Bakken crude railed out to the coasts also bypassed the congested crude oil hub of Cushing, Oklahoma, where WTI is priced. Because of this, at some points, Bakken crude even began to trade at a slight premium to WTI, which was a positive for producers’ revenues.