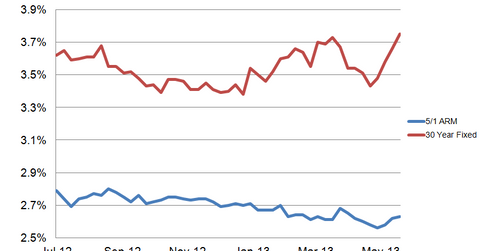

Spread between 5/1 ARMs and 30-year fixed rate mortgages blows out

The spread between the 30-year fixed rate mortgage and the 5/1 ARM changes over time After the financial crisis, Adjustable Rate Mortgages (ARM) got somewhat of a dirty name. Lenders were criticized for using the low “teaser” rate on mortgages to evaluate whether the buyer could afford the home; many borrowers were unable to afford […]

Nov. 20 2020, Updated 2:34 p.m. ET

The spread between the 30-year fixed rate mortgage and the 5/1 ARM changes over time

After the financial crisis, Adjustable Rate Mortgages (ARM) got somewhat of a dirty name. Lenders were criticized for using the low “teaser” rate on mortgages to evaluate whether the buyer could afford the home; many borrowers were unable to afford the house when the adjustable rate kicked in. Some of the products, like negative amortizing mortgages, had such low interest rates that the principal would increase for the first five years – in other words, the payments were not even covering the interest owed. Most of the ARM loans made during the bubble years were never meant to be paid off over 30 years; rather, they were meant to be refinanced. The new Qualified Mortgage rules put out by the Consumer Financial Protection Bureau (CFPB) were meant to put a stop to this sort of practice.

A 5/1 ARM basically means that the initial interest rate is fixed for the first five years of the mortgage. After the initial period, the rate resets every year at some spread to short-term interest rates, usually LIBOR. By contrast, a 30-year fixed rate mortgage will have the same interest rate over the life of the loan. The spread between the two is the compensation for taking interest rate risk (the risk the lender of a 30-year fixed rate mortgage takes).

That said, adjustable rate mortgages are not necessarily a bad deal, and the relevant question is always, “Compared to what?” The spread between the 30-year fixed rate and the 5/1 ARM is worth watching; it can go from high (180 basis points) to low, and even went negative during the financial crisis. It always makes sense for the borrower to calculate the different payments and see how they change as interest rates rise. If you can lock in a spread of 100 basis points over five years, it may take until year eight or nine when the initial savings are used up.

Quantitative easing is causing the spread to move

While adjustable rate To-Be Announced (TBA) securities technically exist, they are very illiquid. So when the Fed is conducting quantitative easing (QE), they are directly influencing the rate of the 30-year fixed rate mortgage, and they are indirectly influencing the 5/1 ARM mortgage rate. Historically, the spread between the 30-year and the 5/1 ARM was close to 80 basis points, and was at those levels a little over a month ago.

As the market began to anticipate the end of quantitative easing towards the end of last year, the 30-year/ARM spread widened over 100 basis points. Earlier this year, we have had some disappointing economic data: Federal Open Market Committee (FOMC) minutes that seemed to indicate that quantitative easing would last at least through this year, and the Bank of Japan has started its own quantitative easing program. As a result, the spread has tightened to just under 80 basis points. However, the 10-year bond has sold off markedly on Fed comments and a strong jobs report. This has driven rates on 30 year fixed rate mortgages higher, while ARMs have increased only slightly. The current spread is 112 basis points, the highest since early 2012.

Implications for mortgage REITs

Like a borrower, mortgage REITs, like Annaly (NLY), and American Capital (AGNC) are constantly comparing the expected returns from 30-year fixed rate mortgages and adjustable rate mortgages. For them, it is a question of interest rate risk. A REIT manager is thinking about having to hedge interest rate risk for the life of the mortgage. For a 30-year fixed rate mortgage, that is the entire life of the loan (setting aside prepayments). For an adjustable rate mortgage, that is only for the first five years. After that initial five year period, the mortgage resets every year to market interest rates. This makes the mortgage much less sensitive to interest rate movements, and saves the investor the cost of hedging. Mortgage REITs, like MFA Financial (MFA) and Hatteras (HTS), invest exclusively in ARMs.

As the spread between the 30-year fixed rate mortgage and adjustable rate mortgages compresses, REITs will switch out of 30-year fixed rate MBS and into ARM mortgages. If the spread becomes narrow enough, REITs will be able to approximate 30-year fixed rate returns with ARMs and save on hedging costs. As interest rate risk falls, they will be able to use higher leverage, which means higher returns. As the spread widens, REITs will find more value in fixed rate mortgages than ARMs.