Primer on mortgage backed securities, Part 1

What are mortgage backed securities? Mortgage backed securities are pools of individual mortgages that have similar characteristics. They allow a relatively illiquid asset (an individual home mortgage) to be converted into a very liquid asset that can be traded with relative ease. They also allow an issuer to divide up the cash flows in order […]

Nov. 20 2020, Updated 12:16 p.m. ET

What are mortgage backed securities?

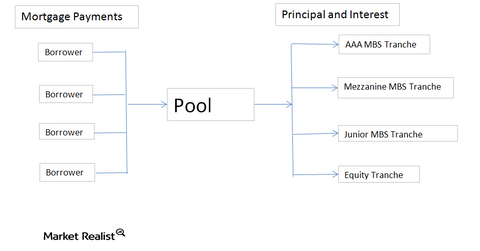

Mortgage backed securities are pools of individual mortgages that have similar characteristics. They allow a relatively illiquid asset (an individual home mortgage) to be converted into a very liquid asset that can be traded with relative ease. They also allow an issuer to divide up the cash flows in order to satisfy investor demand. Mortgage backed securities can run the entire spectrum of credit risk, from Ginnie Mae mortgage backed securities which are backed by the U.S. government to the junior and equity tranches of private label deals. The attached flowchart illustrates the formation of MBS.

History of mortgage backed securities

Mortgage backed securities emerged out of the Great Depression, where an economic shock could wipe out the local bank. In many small towns, the local bank would service the entire town, and if there was a single employer, that bank was extremely exposed. Think of what would happen in a small town built around a single factory or mill. If the mill closed, the locals would have problems paying their mortgages, car loans, etc. A rash of delinquencies could sink the local bank. Securitization allowed the bank to diversify its risk outside of that small town, and also helped people to borrow money even if the local bank could not take on more credit risk. In other words, a lender could be in a different city, state, or country. This was an incredibly important development in banking.

Financial innovation that started in the 1970s allowed the securitization market to really develop as advanced interest rate hedging instruments emerged. Eventually people realized you could securitize almost anything – from auto loans to credit card receivables. Issuers began to develop products that could customize risk exposure, so that investors could find a product that provided exactly the type of returns they were looking for; securitization helps banks in that they are able to recycle their cash. In the past, banks would originate a mortgage, use cash to fund the loan, and then slowly recoup their principal and interest as the loan is paid off. Securitization changed that dynamic. Now, they originate a mortgage, collect origination fees, securitize and sell the mortgage for a mark up which gives them their money back, and then go originate another mortgage.

Continue to Part 2.