Under Armour Stock Slides after Macquarie Downgrade

Under Armour (UAA) started 2018 on a positive note and surged more than 10.0% in the first three trading days of the new year.

Jan. 18 2018, Updated 9:03 a.m. ET

UAA was among the S&P 500’s worst-performing stocks in 2017

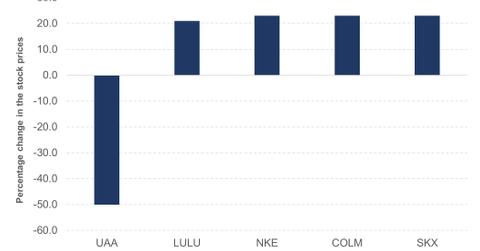

Under Armour (UAA) stock fell 50.0% during 2017, making it among the worst-performing stocks in the S&P 500 Index for the year. Contributing to this slide were its weak financial results and a gloomy near-term outlook.

In comparison, competitors Nike (NKE), Lululemon Athletica (LULU), and Columbia Sportswear (COLM) closed the year with gains exceeding 20.0%.

UAA’s stock performance in 2018

Under Armour (UAA) started 2018 on a positive note and surged more than 10.0% in the first three trading days of the new year. However, recent downgrades by Macquarie and Susquehanna have hit the stock hard.

Susquehanna downgraded UAA’s stock to negative on January 9. “Sell UAA. The Under Armour brand remains at risk,” wrote Susquehanna analyst Sam Poser in a client note. UAA stock closed 5.4% lower after the downgrade.

As we discussed in the previous section, Macquarie downgraded UAA from “neutral” to “underperform” on January 16, 2018. The sportswear maker’s share price sank another 8.7% after the downgrade.

UAA is now sitting at year-to-date losses of 4.3% as of January 16, 2018. The stock is trading at $13.81, 120.0% below its 52-week-high price.

In general, Wall Street doesn’t have a positive view of UAA and isn’t expecting a revival in its stock price in the near future. We’ll explore this topic in the final part of this series.

ETF investors seeking to add exposure to Under Armour can consider the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 0.62% of its portfolio in the company.