Columbia’s 4Q17 Preview: Can COLM Post Solid Results Again?

Portland-based Columbia Sportswear (COLM) plans to release its 4Q17 financial results on Thursday, February 8, 2018.

Jan. 26 2018, Published 5:14 p.m. ET

Snapshot of this series

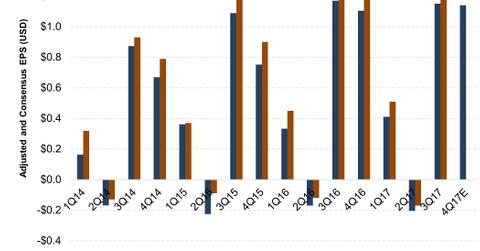

Portland-based Columbia Sportswear (COLM) plans to release its 4Q17 financial results on Thursday, February 8, 2018. Wall Street has projected a 5% YoY (year-over-year) fall in the company’s earnings to $1.14 per share, based on total sales of $760 million, which would represent a 6% YoY sales rise.

Columbia cruised ahead of Wall Street’s earnings and revenue estimates during the first three quarters of the year. (Read the second and third parts of this series to learn more about the company’s recent financial performance and the expectations for the coming quarter.)

Columbia’s stock surged more than 20% in 2017, and it’s so far on a rising spree in the first month of 2018. (Read the fourth part of this series to learn more about Columbia Sportswear’s recent stock market performance.)

COLM stock is covered by 17 Wall Street analysts, who are mostly positive about the company, though the stock was recently downgraded by Goldman Sachs. (Read the fifth and final part of this series to learn about the recent analyst actions on COLM stock.)

About Columbia Sportswear

Founded in 1938, Columbia Sportswear is a global active lifestyle apparel, footwear, and accessories company. It has a presence in over 90 countries.

With a market capitalization of ~$5.3 billion (as of January 23, 2018) and TTM (trailing-12-month) sales of $2.4 billion, Columbia Sportswear is a relatively small player in the sportswear space. By comparison, industry leader Nike (NKE) reported TTM sales of $34.7 billion and has a market cap of ~$109.5 billion.

ETF investors seeking to add exposure to COLM can consider the First Trust Mid Cap Value AlphaDEX Fund (FNK), which invests 0.30% of its total portfolio in the company’s stock.