Can Rising Eurozone Inflation Make European Central Bank Hawkish?

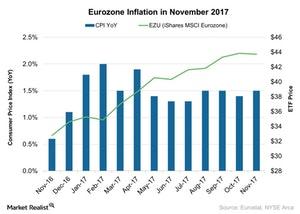

According to Eurostat, on a year-over-year basis, inflation in the Eurozone (VGK) (IEV) (EZU) was 1.5% in November 2017 compared to 1.4% in October 2017.

Dec. 27 2017, Updated 11:50 a.m. ET

Eurozone inflation in November

According to Eurostat, on a year-over-year basis, inflation in the Eurozone (VGK) (IEV) (EZU) was 1.5% in November 2017 compared to 1.4% in October 2017. It met the preliminary reading of 1.5%.

Inflation in November was mainly due to a stronger improvement in energy prices. However, food prices slowed that month. Core inflation, which is an important measure by which the European Central Bank (or ECB) makes various policy decisions, excludes energy, unprocessed food, and tobacco. Core inflation was at 0.9% in November, the same as October’s figure.

Economic impact

Improving economic activity and improvement in inflation is easing concerns for the deflationary situation. The economy of the Eurozone has suffered a lot in the past years due to deflationary pressure. However, in the present situation, an improving economic and inflationary condition is signaling that the ECB might soon follow the Fed and the Bank of England.

The iShares MSCI EMU (EZU), which tracks the performance of the Eurozone (N100-INDEX), fell 0.25% in November 2017.

In the next part of this series, we’ll take a look at the Eurozone consumer confidence in December 2017.