US Dollar Index and Treasury Yields Are Strong on November 30

In the early hours on November 30, the US Dollar Index is trading with strength above opening prices.

Nov. 30 2017, Published 7:54 a.m. ET

US Dollar Index

Following a three-week losing streak, the US Dollar Index started this week on a stable note. The US Dollar Index traded with strength in the first three trading days of the week and opened higher on Thursday. In the early hours on November 30, the US Dollar Index is trading with strength above opening prices.

Market sentiment

The market sentiment was mixed at the beginning of the week amid the decreased risk appetite, which also resulted in the closing of outstanding long positions. However, the sentiment improved amid progress in tax reform plans and renewed strength in equity markets. The market sentiment is also supported by the stronger-than-expected second revision of the US GDP on Wednesday. The market is looking forward to the release of initial jobless claims and personal spending data at 8:30 AM EST today.

At 6:25 AM EST today, the US Dollar Index is trading at 93.39—a gain of 0.25%.

US Treasury yields

After trading with mixed sentiment last week, US Treasury yields started this week on a weaker note. However, Treasury yields regained strength after the upward revision in the US 3Q17 GDP on Wednesday. Treasury yields traded with strength in the early hours on November 30.

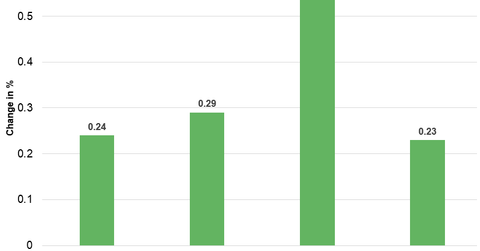

Below are the movements in Treasury yields as of 6:30 AM EST on November 30.

- The ten-year Treasury yield was trading at 2.383—a rise of ~0.29%.

- The 30-year Treasury yield was trading at 2.824—a rise of ~0.24%.

- The five-year Treasury yield was trading at 2.104—a rise of ~0.54%.

- The two-year Treasury yield was trading at 1.766—a rise of ~0.23%.

The iShares 20+ Year Treasury Bond (TLT) fell 0.99%. The ProShares UltraPro Short 20+ Year Treasury (TTT) rose 3.02% and the ProShares UltraShort 20+ Year Treasury (TBT) rose 1.96% on November 29.

In the next part of this series, we’ll discuss how commodities performed in the early hours on November 30.