How Tightening Could Affect Gold Prices

Since the financial crisis, the stock market has risen consistently as long as the Fed continued to buy treasuries and mortgage-backed securities through its quantitative easing policies (QE 1-3).

Oct. 31 2017, Updated 7:32 a.m. ET

VanEck

Reaction to QT Another Example of Market Complacency

Since the financial crisis, the stock market has risen consistently as long as the Fed continued to buy treasuries and mortgage-backed securities through its quantitative easing policies (QE 1-3). However, each time the Fed stopped buying bonds (in 2010, 2011, and 2015), the stock market suffered selloffs in the 10% to 15% range. Now the Fed has reversed course with plans to unwind its massive $4.5 trillion balance sheet (dubbed quantitative tightening or “QT”), yet there are no signs of a market selloff. In fact, the S&P 500 has trended to new all-time highs, NYSE margin debt is at all-time highs, and the CBOE Volatility Index (VIX) hovers around lows last seen in 2007. Perhaps markets don’t care about QT because of the small initial runoff of $10 billion per month and the fact that it has been well telegraphed. However to us, it looks more like this market has a level of complacency rarely seen in history. A recent New York Times article by Yale Professor of Economics Robert Shiller shows current stock market valuations in a range experienced only in 1929 and between 1997 and 2002. To look for a reason as to why the current high valuations have so far failed to “precipitate those ugly declines in the past”, he searches newspaper archives and finds mass psychology to be in a “different, calmer place” today. Widespread fear of a speculative bubble is not evident in the current market. Dr. Shiller is at a loss as to why people are so calm about the markets and suggests maybe investors are distracted by the endless news flow around geopolitics, natural disasters, and violence.

Market Realist

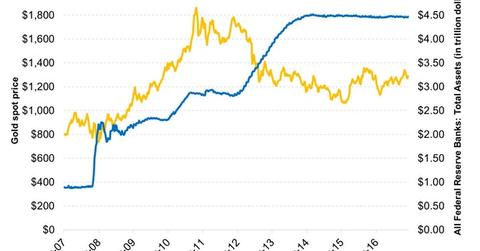

When the Fed started its quantitative easing or QE program after the financial crisis, gold (OUNZ)(IAU) prices started surging as the program sent interest rates to all-time lows.

However, the Fed’s infamous taper tantrum and the eventual winding down of the QE program led to downward pressure on gold prices. Remember, gold does well when interest rates are low.

Over the last ten years, gold prices and the Fed’s total assets have had a correlation of -0.29 with gold prices. When the Fed eventually starts trimming its balance sheet, interest rates are bound to rise, which could negatively affect gold prices.

However, as we saw earlier, complacency in the equity markets (IVV) could lead to a correction—especially if there’s a trigger, like weak earnings growth, which could lift gold prices as investors look for safe havens.