Municipal Bonds’ Credit Quality Still Prevails

In this series, we will shed light on Moody’s recent data report, US Municipal Bond Defaults and Recoveries, 1970–2016. Muni bond prices sparked in 2016, especially when President Trump announced his infrastructure spending plans.

Oct. 11 2017, Published 10:23 a.m. ET

VanEck

Updated statistics from Moody’s Investors Service[1.Moody’s Investors Service: US Municipal Bond Defaults and Recoveries, 1970-2016, June 27, 2017.] confirm two benefits muni bonds continue to provide. First, municipal credits remain highly rated with, in 2016, upgrades narrowly outpacing downgrades.[2.Moody’s Investors Service: Rating drift measures the net average number of notches a credit will change over the study period. It is defined as the average upgraded notches per issuer minus the average downgraded notches per issuer.] Second, municipal bankruptcies and defaults remain rare.

On June 27, 2017, Moody’s released its updated annual default research report using 2016 figures. The study encompasses data on all Moody’s rated U.S. municipal bonds for the 46 year period from 1970 through the end of 2016.

The latest report features two changes from prior years. Most notably Moody’s framework shifted from being security-based to being sector-focused, to better capture “inherent credit distinctions and rating volatility in the municipal sector.” The upshot of this is that the Moody’s universe is now split into three broad sectors: 1) General Governments, 2) Municipal Utilities, and 3) Competitive Enterprises.

To save you the trouble of diving into the 101-page document, we have identified three key takeaways.

Market Realist

What are muni bonds?

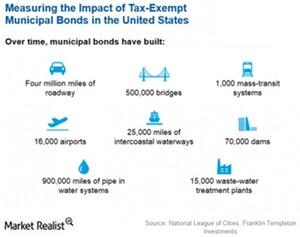

A municipal bond (ITM) (PRB), more commonly known as a “muni bond,” is a debt security issued by a country’s government or municipality. The primary purpose of muni bonds is to finance public projects such as the construction of roads, bridges, and hospitals.

Muni bonds offer investors two choices—income-taxable and tax-exempt. Tax-exempt muni bonds in the United States are attractive, as they are not subject to federal taxes. In most cases, they are also exempt from state and local taxes. The chart below shows various projects supported by municipal bonds.

Municipal bonds (MLN) have made significant, long-time contributions to infrastructure in the United States. Muni bond prices were distressed in 2016, especially when President Trump announced his infrastructure spending plans after the election. The new administration’s infrastructure spending plans could increase the issuance of muni bonds, which could boost supply and bring down prices.

The muni bonds supply is already at a peak. The US municipal bond market issuance stood at $3.7 trillion at the end of 2016.[3.Bloomberg, Barclays, US Federal Reserve] The holders of municipal bonds (XMPT) (SMB) comprise various entities, as depicted in the chart below:

Focus of this series

In this series, we will shed light on Moody’s recent data report, US Municipal Bond Defaults and Recoveries, 1970–2016. Three key takeaways from the report are municipal bonds’ ratings and performance in 2016, muni bonds’ rare default occurrence, and Puerto Rico’s role in the 2016 muni bonds (ITM) default, which we’ll discuss later in this series.

Let’s dig into each topic.