Will Free Cash Flow Halt Dividend Growth for General Electric?

In the last ten years, GE has raised its cash dividends to common for seven of those years. The annualized $0.96 per share dividend results in a dividend payout ratio of 61.1%.

Sept. 11 2017, Updated 2:36 p.m. ET

GE’s dividend payout

The quantum of dividends distributed to stockholders relative to the quantum of total net income is called a dividend payout ratio. The amount held back and not distributed by the company is for growth. For General Electric (GE), its dividend payout ratio denotes the percentage of GE’s net income paid out as a dividend.

General Electric’s (GE) dividend compound annual growth rate in the last seven years ending 2016 was around 7.0%. In the last ten years, GE has raised its cash dividends to common for seven of those years. The annualized $0.96 per share dividend results in a dividend payout ratio of 61.1%.

A look at GE’s free cash flows

A company’s free cash flow (or FCF) is the leftover cash after deducting capital expenditure from its operating cash flows. Normally, companies utilize the leftover cash for stock repurchases, reinvestments in business, and dividend payments.

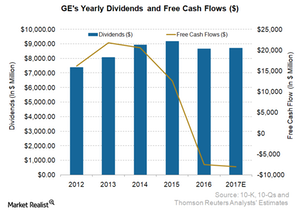

The above graph shows a sharp fall in General Electric’s FCF in recent years. Analysts surveyed by Thomson Reuters haven’t projected a rise in GE’s FCF in the current fiscal year. From $20.0 billion in 2014, FCF has fallen to $12.6 billion. FCF was negative in 2016 at -$7.5 billion.

For fiscal 2017, GE anticipates FCF of ~$14.0 billion. That includes the GE Capital dividend of $6.0 billion paid to the parent. Now, the yearly cash equity dividends of $8.4 billion are much higher than FCF. If we count FCF alone, the company’s support levels are inadequate to fund any dividend growth in the future.

ETF investment

General Electric stock is held by 112 ETFs. If you want indirect exposure to GE, you can opt for the iShares Global Industrials (EXI). GE forms around 5.0% of EXI’s portfolio holdings. Excluding GE, major industrial companies included in EXI are Boeing (BA), 3M (MMM), Honeywell International (HON), and Siemens.

In the next part, we’ll compare GE’s forward dividend yield with its peers in the industrial sector.