Where Does NextEra Energy Really Stand in 2H17?

NextEra Energy is one of the fastest-growing utilities in the country. In this series, we’ll discuss its operational and financial metrics and see whether it’s attractive from a long-term investment perspective.

Nov. 20 2020, Updated 1:47 p.m. ET

NextEra Energy

Utility investors are generally in search of high yields and relatively smooth stock price movements. NextEra Energy (NEE) might not fit the bill in these categories but could charm conservative investors.

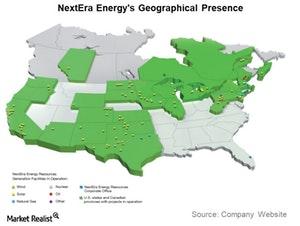

Florida-based NextEra Energy is the largest utility by market capitalization in the sector (XLU). It has a presence in 27 states in the US and four provinces in Canada. With 45,000 megawatts of capacity, it’s the third largest utility in the country by capacity. NextEra Energy prominently operates in Florida through its principal subsidiary, Florida Power and Light, and serves 4.9 million customers.

One of the fastest-growing utilities

NextEra Energy is one of the fastest-growing utilities in the country. Its earnings have risen more than 8.0% in the last three years compounded annually, outpacing the targeted 6%. NextEra Energy targets earnings growth of 6% to 8% through 2020. The solid earnings growth has fuelled the stock’s rise in the last few years. The stock has managed to double in the last five years.

NextEra Energy is one of the largest renewable energy developers in the world. In 2016, it had 16 GW (gigawatts) of wind and solar capacity. It expects to expand this capacity by 23 GW to 28 GW by 2020. NextEra has the largest renewables portfolio in the country.

NextEra Energy has long been pursuing an acquisition target for expansion. In 2015, its Hawaiian Electric acquisition was rejected by regulators. In 2017, NextEra Energy’s deal with Oncor was also rejected.

In this series, we’ll see how NextEra Energy places itself in the changing utility industry and how it distinguishes itself from peers. We’ll discuss its operational and financial parameters and see whether it’s attractive from a long-term investment perspective.