What’s Driving Emerging Markets Local Currency Debt?

During the past two decades, EM (emerging markets) local debt has evolved to become the largest and most liquid debt market within the emerging market bond space.

Sept. 28 2017, Published 1:35 p.m. ET

VanEck

The emerging markets local debt universe has grown tremendously over the past several years. Within the last five years, the investable universe has grown 37% to $1.2 trillion versus approximately $900 billion of U.S. dollar-denominated sovereign debt.1 Investors today benefit from a more diverse opportunity set with greater market depth, in addition to the attractive yields offered by the asset class.

1Source: J.P. Morgan

Market Realist

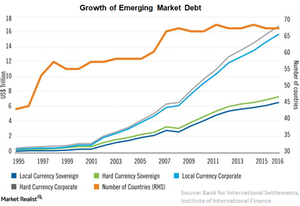

Emerging markets local debt is rapidly expanding

During the past two decades, EM (emerging markets) local debt has evolved to become the largest and most liquid debt market within the emerging market bond space. EM local bonds (FEMB) offer two potential sources of income. While higher local interest rates relative to the US markets lead to higher bond yields, local currency fluctuation against the US dollar could also significantly contribute to total bond returns.

Surpassed hard currency market

The EM debt comprising local and hard currency markets has grown rapidly over the past two decades. The outstanding EM government and corporate debt expanded from $0.6 trillion in 1995 to $17.1 trillion in 2016. The sharp growth in emerging market local currency bonds has been mainly driven by a greater issuance of local currency debt (LEMB) (EMLC) compared to foreign currency bonds. The local currency government debt (ELD) market in emerging countries is now over eight times larger than the hard currency market.

Attractive yields

As per estimates, around 10% of this local debt is held by foreign investors. Foreign investors were mainly attracted to EM debt due to relatively high yields compared to very low yields prevalent in the developed markets. According to JPMorgan Securities, the average yield for emerging market government bonds was 5.3% at the end of July 2017 compared to 1.9% in developed markets.

Meanwhile, emerging market local currency bonds (EBND) on the Bloomberg Barclays Index have provided a year-to-date return of 13.5% as of September 19, 2017, compared to 7.8% for hard currency bonds and 3.4% for the US Aggregate Bond Index.