Welltower’s Dividend Yield Falls despite Higher Dividend

Revenue and earnings In this part, we’ll look at Welltower (HCN), a US healthcare REIT. Welltower’s revenue growth slowed from 15% in 2015 to 11% in 2016. The growth was driven by all of its segments, through rental income, resident fees and services, interest income, and other income. Its operating costs and other expenses (including interest expenses) […]

Sept. 18 2017, Published 11:15 a.m. ET

Revenue and earnings

In this part, we’ll look at Welltower (HCN), a US healthcare REIT. Welltower’s revenue growth slowed from 15% in 2015 to 11% in 2016. The growth was driven by all of its segments, through rental income, resident fees and services, interest income, and other income.

Its operating costs and other expenses (including interest expenses) rose 9% and 11% in 2015 and 2016, respectively. A gain on the sale of discontinued operations contributed to 61% EPS (earnings per share) growth in 2015. The company has not only generated positive FFO (funds from operations) since 2014 but has also recorded growth.

Revenue and EPS in 1H17

In 1H17, Welltower’s revenue remained flat, driven by senior housing and outpatient medical revenue. Its resident fees and services rose.

Its operating costs and other expenses rose 6%, whereas its interest expenses fell, offset by a debt extinguishment loss and asset impairment. A gain on the sale of discontinued operations contributed towards 43% growth in its 1H17 EPS. It managed to generate positive FFO, though they fell 15% from 1H16.

Dividend

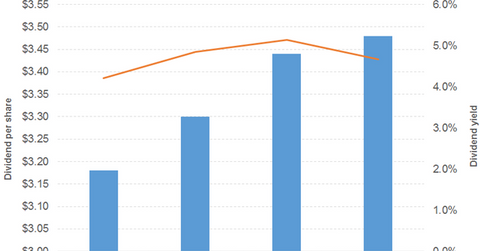

The company has seen a consistent increase in its dividend. Its dividend payout fell in 2015 and 2016, and has risen in 2017. Its 1H17 dividend payout was lower than its 1H16 payout.

Stock price

As shown in the chart above, Welltower has beaten the SPDR S&P Regional Banking ETF (KRE) most of the time over the last three years. The stock has been mostly on par with the SPDR Dow Jones REIT ETF (RWR), which has an exposure to healthcare REITs.

The Vanguard International Dividend Appreciation Index ETF (VIGI) offers a dividend yield of 1.7%, at a PE (price-to-earnings) ratio of 26.8x. It has a 22%, 10%, and 2% exposure to healthcare, financials, and real estate, respectively. The Legg Mason Low Volatility High Dividend ETF (LVHD) offers a dividend yield of 1.7%, at a PE ratio of 16.7x. It has a 17% and 3% exposure to real estate and financials, respectively.