What Led to BlackRock’s Downward Sloping Dividend Yield Curve?

BlackRock posted a 7.0% revenue growth in the first half of 2017, driven by every segment except multi-asset and alternatives, which reported flat growth.

Sept. 20 2017, Published 11:09 a.m. ET

A look at BlackRock’s revenue and earnings

In this part of the series, we’ll look at BlackRock (BLK), an international investment management corporation. Its revenue fell 2.0% in 2016 after a 3.0% rise in 2015. Equity, fixed income, multi-asset, cash management, and BlackRock Solutions and advisory posted growth in 2015, offset by the alternatives segments. In 2016, it saw growth only in fixed income, cash management, and BlackRock Solutions and advisory, offset by the rest. Operating income fell 2.0% in 2016 after a 4.0% growth in 2015. The slump in revenue in 2016 offset the decrease in expenses for the corresponding period. Diluted EPS (earnings per share) for 2016 also fell 4.0% after a 3.0% rise in 2015, while the company managed to bring down its interest expenses. The EPS numbers have been further enhanced by share buybacks.

BlackRock posted a 7.0% revenue growth in the first half of 2017, driven by every segment except multi-asset and alternatives, which reported flat growth. Operating income rose 12.0% despite higher expenses. All that translated to a 21.0% diluted EPS growth despite higher interest expenses. EPS was also enhanced by share buybacks. The company has maintained a sound free cash flow balance, although it has fallen over the years.

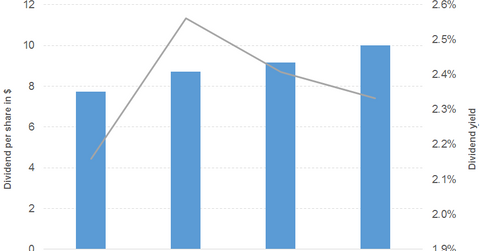

BlackRock’s dividend trajectory

The downward shift in BlackRock’s dividend yield curve since 2015 despite the dividend increase is due to the rise in prices, as we can see in the chart below. However, the company has maintained a 2.0% dividend yield.

Let’s look at two dividend ETFs with exposure to BlackRock. The iShares Select Dividend ETF (DVY) offers a 3.0% dividend yield at a PE (price-to-earnings) multiple of 20.3x. It has a 30.0% exposure to utilities. The iShares Core High Dividend ETF (HDV) offers a 3.3% dividend yield at a PE multiple of 21x. It has a 21.0% exposure to consumer non-cyclical.