How Weyerhaeuser Compares with Peers

The expected performance of timberland REIT Weyerhaeuser (WY) for the rest 2017 and in 2018 can be best understood by its valuation multiples.

Sept. 13 2017, Updated 10:36 a.m. ET

Which valuation multiple to consider for timberland REITs?

The expected performance of timberland REIT (real estate investment trust) Weyerhaeuser (WY) for the rest 2017 and in 2018 can be best understood by its valuation multiples.

The most common multiple used for evaluating the company is the PE (price-to-earnings) ratio. The multiple indicates how much an investor pays for a stock per unit of earnings it generates.

WY’s PE ratio

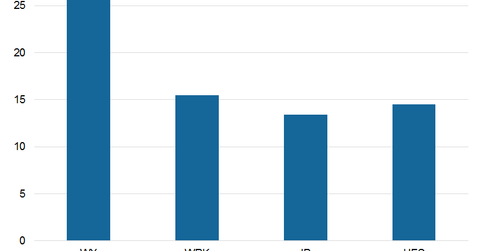

Weyerhaeuser trades at a forward or NTM (next-12-month) PE ratio of 27.2x. The company’s PE ratio is at a premium to those of Domtar (UFS), Westrock (WRK), and International Paper (IP), who are trading at PE multiples of 14.51x, 15.50x, and 13.39x, respectively.

The premium multiple of WY stock can be explained by the fact that the investors showed confidence in the stock after its recent strategical decisions to maintain profitability. WY’s upbeat results in 2Q17 and 1H17 sent the stock price into a rally, which has also increased the confidence of investors on the stock.

EV-to-EBITDA multiple

WY has an EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 19.0x, which is at a premium to Rayonier (RYN), Domtar (UFS), and Resolute Forest Products (RFP), who are trading at multiples of 13.85x, 5.80x and 5.37x, respectively.

Notably, Weyerhaeuser (WY), Rayonier (RYN), and International Paper (IP) make up ~20% of the iShares Global Timber & Forestry ETF (WOOD), which has a year-to-date return of ~20.1%.