A Look at Kellogg’s Dividend Yield Curve

Kellogg has noted a 3.0% fall in sales for the first half of 2017. The fall is due to a decline in every segment, offset by U.S. Specialty, Latin America, and Asia Pacific.

Sept. 20 2017, Published 11:10 a.m. ET

Kellogg’s revenue and earnings

Let’s take a look at Kellogg (K), a food manufacturing MNC (multinational corporation) involved in the manufacturing and marketing of ready-to-eat cereal. It recorded a 4.0% fall in its 2016 net sales compared to 7.0% in 2015. In 2015, it witnessed a fall in every segment, including U.S. Morning Foods, U.S. Snacks, U.S. Specialty, North America Other, Europe, Latin America, and Asia Pacific. In 2016, it reported growth in U.S. Specialty, offset by the rest. Operating profits posted a 28.0% growth in 2016 compared to 7.0% in 2015. The growth was mainly due to lower SG&A (selling, general, and administrative) expenses followed by gross margin. Diluted EPS (earnings per share) rose 14.0% in 2016 after a 2.0% fall in 2015, despite rising interest expenses. EPS was further enhanced by share buybacks.

Kellogg has noted a 3.0% fall in sales for the first half of 2017. The fall is due to a decline in every segment, offset by U.S. Specialty, Latin America, and Asia Pacific. Operating profits fell 8.0% after higher SG&A expenses. Diluted EPS rose 19.0% following a fall of 56.0% in interest expenses. EPS was further enhanced by share buybacks. The company has maintained a good free cash flow balance.

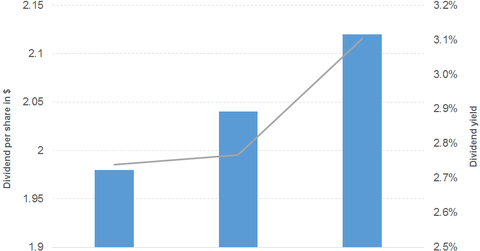

Kellogg’s dividend trajectory

The gradual upward shift of the dividend yield curve is due to both the increase in dividends and the decrease in prices, as we can see in the price chart below. The company has currently breached the 3.0% dividend yield mark.

Let’s look at two dividend ETFs with exposure to Kellogg. The PowerShares S&P 500 High Dividend ETF (SPHD) offers a 3.6% dividend yield at a PE (price-to-earnings) multiple of 17.3x. It has a 24.0% exposure to real estate. The WisdomTree Dividend ex-Financials ETF (DTN) offers a 3.1% dividend yield at a PE multiple of 19.6x. It has a 16.0% exposure to utilities.