What Could Benefit Kraft Heinz’s Earnings in 2Q16?

Analysts’ expectations for KHC’s earnings look optimistic for the rest of 2016. Its earnings are expected to rise by 70% and 44% in 3Q16 and 4Q16.

July 29 2016, Updated 11:06 a.m. ET

2Q16 EPS

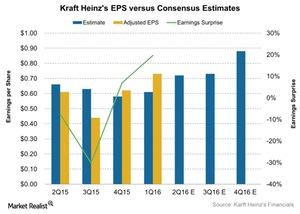

In this part, we’ll look at analysts’ EPS (earnings per share) estimates for Kraft Heinz (KHC) in 2016. Analysts expect Kraft Heinz’s adjusted EPS to be $0.72, compared to its 2Q15 EPS of $0.61. This represents a rise of 17%. In the last four quarters, the company has missed and beaten estimates twice each.

Analysts’ expectations for 2016

Analysts’ expectations for KHC’s earnings look optimistic for the rest of 2016. The company’s earnings are expected to rise drastically by 70% and 44%, respectively, in 3Q16 and 4Q16. For 2016, KHC’s EPS is estimated to be $3.07, a rise of 40% compared to its EPS of $2.19 in 2015.

The company could benefit further from cost-savings strategies and favorable pricing. It expects to see stronger EPS in 2H16, driven by expected earnings accretion from refinancing its preferred stock in June 2016.

The Kraft-Heinz merger

Kraft Heinz was formed when Kraft Foods was acquired by the Pittsburgh-based and privately owned H.J. Heinz Holding in October 2014. The company changed its name to Kraft Heinz after the merger. It became the third-largest food and beverage company in North America. It’s the fifth-largest food and beverage company in the world.

3G Capital, a Brazilian private equity company, completed the merger deal along with Warren Buffett’s Berkshire Hathaway. Together, they invested $10 billion in the deal.

Earnings estimates for KHC’s peers

Kraft Heinz’s peers in the food and packaging industry include ConAgra Foods (CAG), Campbell Soup Company (CPB), and Flowers Foods (FLO).

- Flowers Foods’ EPS for 2Q16 are expected to rise by 3%.

- ConAgra Foods’ EPS for fiscal 1Q17 are projected to rise by 2%.

- Campbell’s EPS for fiscal 4Q16 are expected to rise by 16%.

To gain exposure to Kraft Heinz, you can invest in ETFs such as the iShares S&P Global Consumer Staples ETF (KXI) and the iShares Morningstar Large Value ETF (JKF). They invest 1.4% and 1.0% of their portfolios, respectively, in Kraft Heinz.

In the next part, we’ll discuss what dividends the company has paid to date and its 2016 outlook.