How Geography Affected AvalonBay’s 2Q17 Results

Wide geographical diversity AvalonBay Communities (AVB) has its assets well placed in high-demand Class A cities. These cities have soaring job growth, a high barrier to entry for competitors, and proximity to premium infrastructure. REIT peers UDR (UDR), Equity Residential (EQR), and Essex Property Trust (ESS) are repositioning their properties to Class A cities and […]

Aug. 10 2017, Updated 7:36 a.m. ET

Wide geographical diversity

AvalonBay Communities (AVB) has its assets well placed in high-demand Class A cities. These cities have soaring job growth, a high barrier to entry for competitors, and proximity to premium infrastructure.

REIT peers UDR (UDR), Equity Residential (EQR), and Essex Property Trust (ESS) are repositioning their properties to Class A cities and expanding with new leased activities to maintain rent growth. These REITs occupy 13% of the SPDR Dow Jones REIT ETF (RWR), which has a net asset value of $93.17 per share.

Regional performance in 2Q17

Communities that performed strongly above expectations include Avalon West Hollywood in Los Angeles and AVA NoMa in DC. Both communities reported effective rental rates of around $300 per month.

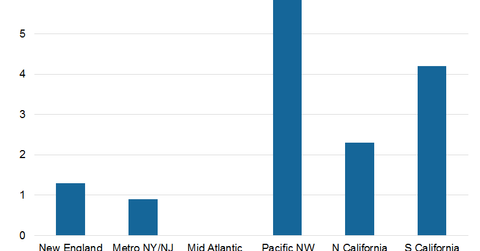

The Pacific Northwest region reported a maximum average rental rate growth of 5.1% during the quarter. It was followed by Southern California with 3.9% growth, New England with 2.7% growth, the Mid-Atlantic region with 2.4% growth, and the New York metropolitan area with 2.2% growth. Northern California reported the lowest average rental growth of 0.9%.

Most of the regions reported a decline in occupancy, with the Mid-Atlantic reporting the largest decline of 0.7%. Northern California reported the highest occupancy growth of 0.5%.

The Pacific Northwest reported NOI (net operating income) growth of 5.9% during the quarter. It was followed by Southern California with a growth of 4.2%. The Mid-Atlantic region’s NOI growth was flat.