How Are Gold and Bitcoin Different?

Bitcoins can be sent across borders. Bitcoin payment will be the same as paying someone in the same country. People don’t use gold much anymore.

Aug. 28 2017, Published 2:16 p.m. ET

VanEck

Gold versus Bitcoin

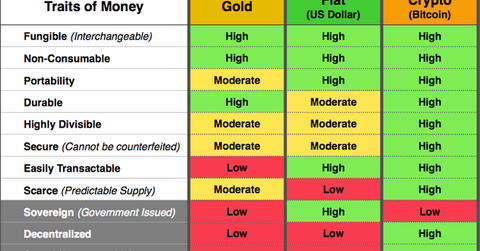

However, there are a range of significant differences:

- Gold has been established as a store of wealth throughout human history. Gold’s market capitalization is roughly $8 trillion, of which $3 trillion is in coin and bar form. Approximately $50 billion worth of gold trades each day. Bitcoin is microscopic in comparison with a market capitalization of approximately $45 billion and $1.5 billion in daily trading volume.

- Gold can be stored anywhere. If stored at home, it can be used for barter the next time a hacker or solar flare takes down the grid. Digital currencies are worthless without electricity. Taking delivery will always be impossible with digital currency.

- Bitcoin mining is a difficult concept to fathom. Bitcoin miners use computer programs to solve complex math problems and receive in exchange new bitcoins. What does this activity have to do with creating a store of wealth?

- Most bitcoin markets are lightly regulated and are located outside of the U.S. A major potential drawback to digital currency is their use for money laundering, illegal trading, computer ransom attacks, tax avoidance, and to subvert exchange controls. Expect governments to intervene heavily if any of these activities become significant. Over the past year the People’s Bank of China (or PBOC) forced the three biggest bitcoin exchanges to adhere to anti-money laundering rules, implement trading fees, and then forced them to halt bitcoin withdrawals.

- Distributed ledgers are promoted as unhackable. However, police were recently able to find the digital keys to an online criminal’s accounts and seize approximately $8 million in digital currencies.

- Digital currency has yet to stand the test of time. We do not know if a digital currency that is secure today will be secure under new technology. Distributed ledger passwords could be relatively easily broken if quantum computing becomes a reality.

Market Realist

Bitcoins can be sent across borders. Bitcoin payment will be the same as paying someone in the same country. In contrast, while traditional currencies are easily circulated within countries, international payments are much more difficult.

A payment through a wire transfer usually goes through a number of banks. The payment is more expensive and takes much longer to process compared to bitcoin. Meanwhile, people don’t use gold (OUNZ) (IAU) much as a means to trade anymore.

Gold is usually delivered in certain sizes. One gram of gold still costs ~$40 ($1,250 per troy ounce). Currencies (VTVT) are easily divisible up to two decimal points—for example, $0.01. However, bitcoin is even more divisible. Currently, it supports up to eight decimal points. You can easily buy a smaller part of bitcoins.