Dividend Yield of Cardinal Health

Cardinal Health’s (CAH) PE ratio of 16.0x compares to a sector average of 20.4x. The dividend yield of 2.9% compares to a sector average of 2.0%.

Aug. 23 2017, Published 12:43 p.m. ET

Cardinal Health: Services sector, drugs wholesale industry

Cardinal Health (CAH) is a global specialty distributor of pharmaceuticals and medical products. It has recorded consistent growth in revenue, driven by the pharmaceutical and medical segments. However, revenue growth for the pharmaceutical segment fell in fiscal 2017 compared to fiscal 2016 due to generic pharmaceutical pricing, the company’s investment in its pharmaceutical IT (information technology) platform, and a slowdown in branded manufacturer price appreciation. Acquisitions also made a crucial contribution to fiscal 2016 growth. Growth for the medical segment in fiscal 2016 outdid that of fiscal 2017 due to substantial acquisitions and divestitures in fiscal 2016. The company’s EPS (earnings per share) has gradually risen over the years. EPS for fiscal 2017 fell compared to fiscal 2016 due to higher operating expenses and interest expenses, partially offset by share buybacks.

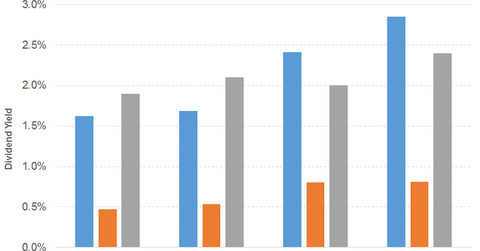

In the graph below, we can see Cardinal Health’s dividend yield compared to the S&P 500 and McKesson (MCK). (The asterisk in the graph denotes an approximation in calculating dividend yield.)

Consistent dividend growth

Cardinal Health has recorded consistent growth in dividends since at least May 2003. Free cash flow fell in fiscal 2017 after recording a growing trend in the previous years. The decline was due to a slump in operating cash flow. The dividend yield, which has recorded an occasional rise and fall, is currently above the S&P 500.

The company’s PE (price-to-earnings) ratio of 16.0x compares to a sector average of 20.4x. The dividend yield of 2.9% compares to a sector average of 2.0%. In the graph below, we can see Cardinal Health’s price movement compared to the S&P 500 and McKesson.

Cardinal Health’s acquisition of Medtronic’s Patient Care, Deep Vein Thrombosis, and Nutritional Insufficiency businesses is expected to drive its fiscal 2018 profit numbers for its medical segment as well as EPS (earnings per share). The generic pharmaceutical customer pricing changes have the potential to affect the fiscal 2018 pharmaceutical segment profit much like fiscal 2017.

The iShares Core Dividend Growth (DGRO) offers a dividend yield of 2.1% at a PE ratio of 20.6x. It’s a diversified ETF. The First Trust STOXX European Select Dividend ETF (FDD) offers a dividend yield of 3.3% at a PE ratio of 14.5x. The diversified ETF has a substantial exposure to financials.