How to Benefit from Emerging Markets Corporate Debt

VanEck Higher Yield and Lower Duration Compared to U.S. high yield bonds, emerging markets high yield bonds offered a 90 bps yield pickup as of June 30, 2017.[1.U.S. high yield bonds and emerging markets high yield bonds are represented by BofA Merrill Lynch US High Yield Index and BofA Merrill Lynch Diversified HY US Emerging […]

Aug. 21 2017, Published 12:03 p.m. ET

VanEck

Higher Yield and Lower Duration

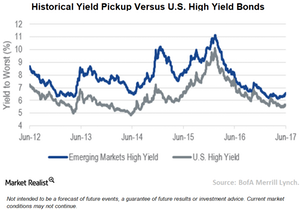

Compared to U.S. high yield bonds, emerging markets high yield bonds offered a 90 bps yield pickup as of June 30, 2017.[1.U.S. high yield bonds and emerging markets high yield bonds are represented by BofA Merrill Lynch US High Yield Index and BofA Merrill Lynch Diversified HY US Emerging Markets Corporate Plus Index, respectively.] The extra yield came with a lower duration (3.75 vs. 4.04) and a higher average credit quality. Approximately 60% of the emerging markets high yield index is rated BB- or higher versus less than 50% in its U.S. counterpart.

Market Realist

Emerging markets corporate debt provides better risk adjusted returns

For fixed income investors seeking higher returns, emerging market corporate debt provides more attractive yield opportunities, lower duration (duration measures the sensitivity of a bond to changes in interest rate), and better quality profile compared to U.S. speculative-grade debt (JNK) (HYG). This is in addition to providing investors with exposure to economies that are growing much faster than many other developed countries, thus providing potentially higher returns.

Higher returns with less volatility

EM (Emerging Markets) corporate bonds (EMB) (PCY) have historically provided higher returns and that too with lower volatility compared to other assets. For the 10-year ended May 31, 2016, EM corporate bonds provided 6.52% annualized returns, much higher than 3.44% returns generated by the EM equities. Over the same period, EM stocks were almost three times more volatile than EM corporate bonds. During those 10-years, EM corporate debt also provided better risk-adjusted returns than Global Investment Grade Corporate Bonds.

Better credit quality

EM corporates (CEMB) possess better credit quality, with a majority of the market rated investment grade while only 2% is rated extremely high-risk grade (bonds with ratings of CCC or below). Additionally, the EM companies issuing debt have low leveraged compared to the US corporates. According to Bank of America Merrill Lynch, overall the EM companies are 14% less leveraged than their US counterparts while among high yield bond issuers, EM corporates are 46% less leveraged than US corporates.