Under Armour’s 2Q17 Footwear Sales Lose Traction

Footwear growth turns negative Under Armour’s (UAA) footwear business was considered the company’s growth engine until recently. The company recorded average quarterly growth of 52% between fiscal 2014 and 2016. However, 2Q17 was a complete letdown. Sales were down 2% YoY (year-over-year) as the company coped with tough comparisons with the year prior. Also impacting sales […]

Aug. 31 2017, Updated 6:56 p.m. ET

Footwear growth turns negative

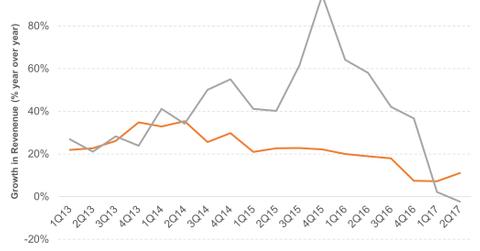

Under Armour’s (UAA) footwear business was considered the company’s growth engine until recently. The company recorded average quarterly growth of 52% between fiscal 2014 and 2016.

However, 2Q17 was a complete letdown. Sales were down 2% YoY (year-over-year) as the company coped with tough comparisons with the year prior. Also impacting sales were ongoing inventory management initiatives, particularly in North America.

According to MarketWatch, Instinet analysts stated that “although apparel growth accelerated this quarter to 11%, footwear, after being labeled as the prime driver for Under Armour’s next leg of growth, went negative, which should raise significant questions around Under Armour’s ultimate addressable market size as it relates to Nike and Adidas, which scaled via their much larger footwear businesses.” In comparison, industry leader Nike (NKE) posted 4% growth in footwear sales in North America and 8% growth globally when it reported its quarterly results in June.

How did the apparel business fare?

Sales of Under Armour’s apparel business, however, have improved from the last two quarters. Revenue was up 11% YoY, primarily driven by solid results in the men’s training, women’s training, and golf segments. Its revenue growth outpaced Nike’s 3% jump in apparel sales in the most recent quarter.

Investors seeking exposure to Under Armour could consider the PowerShares S&P 500 High Beta Portfolio ETF (SPHB), which invests 0.8% of its portfolio in the company. Read about the company’s margins in the next part of this series.