Understanding DOW’s High 2Q17 Revenue Hopes

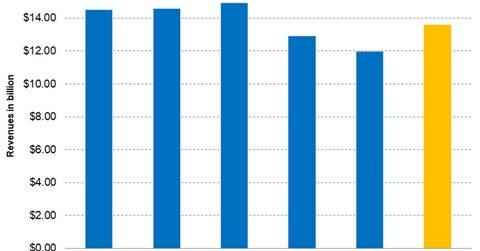

As of July 21, 2017, analysts are expecting Dow Chemical (DOW) to post revenues of ~$13.6 billion for 2Q17, which would represent a 14.0% rise on a YoY basis.

July 24 2017, Updated 1:05 p.m. ET

Dow Chemical’s 2Q17 revenue estimate

As of July 21, 2017, analysts are expecting Dow Chemical (DOW) to post revenues of ~$13.6 billion for 2Q17, which would represent a 14.0% rise on a YoY (year-over-year) basis. In 2Q16, DOW reported revenue of just under $12.0 billion.

If DOW manages to meet or beat the analysts’ revenue estimates, it will be its highest revenue in nine quarters.

Driving factors

DOW expects its revenue growth in 2Q17 to be driven by the inclusion of the Dow Corning silicon business. DOW completed the acquisition of the remaining stake of the joint venture between Dow Chemical and Corning (GLW) on June 1, 2016, and DOW’s revenue has improved for the past three quarters since that time.

The completion its Elite enhanced polyethylene production facility in Texas could add to DOW’s revenue, though it’s not expected to be fully operational until the fourth quarter. The commercialization of Sadara’s plastic franchise and the weakness in US dollar are expected to drive DOW’s revenue in 2Q17.

This growth signals growing demand for infrastructure, automotive, and packaging, all of which are expected to be positive for DOW in 2Q17.

Investors can indirectly hold Dow Chemical by investing in the Vanguard Materials ETF (VAW), which has 9.2% in DOW. VAW’s other holdings include DuPont (DD) and Monsanto (MON), which had weights of 8.4% and 5.9%, respectively, in the fund on July 20, 2017.