How Dow Chemical’s Consumer Solutions Segment Performed in 2Q17

Dow Chemical’s (DOW) Consumer Solutions segment is the fourth largest segment in terms of revenue.

Aug. 1 2017, Updated 7:38 a.m. ET

Dow Chemical’s Consumer Solutions segment in 2Q17

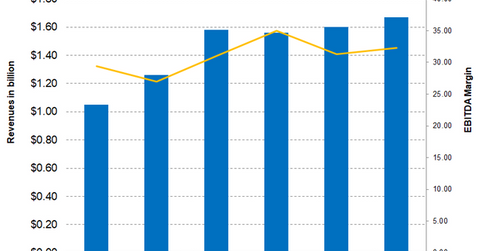

Dow Chemical’s (DOW) Consumer Solutions segment is the company’s fourth largest segment in terms of revenue. This segment accounted for 12.1% of DOW’s total revenue in 2Q17 as compared to 10.6% in 2Q16, reflecting an increasing trend in its contribution to DOW’s overall revenue. The segment reported revenue of $1.7 billion in 2Q17, an increase of 33.3% on a year-over-year basis. In 2Q16, the segment reported revenues of $1.3 billion.

The segment’s revenue rose primarily due to the continued revenue recognition from the addition of the DOW-Corning silicones business. Excluding this, the segment grew by 8%, and growth came from all businesses and regions. Higher growth came from the segment’s Electronic Materials business due to increased demand for semiconductors. Further, new business wins also helped to increase the segment’s revenue. However, the segment revenue was adversely impacted by the currency hedging strategy.

Segment EBITDA and margins

The segment reported operating EBITDA (earnings before interest, taxes, depreciation, and amortization) of $541 million, an increase of 58.6% on a year-over-year basis driven by the addition of the silicon business and new business wins. However, the increase in raw materials costs and currency translations had an adverse impact. The segment’s EBITDA margin for 2Q17 stood at 32.3% as compared to 27% in 2Q16, an increase of 530 basis points.

Investors looking for exposure to Dow Chemical can invest in the Vanguard Materials ETF (VAW), which invests 9.3% of its portfolio in DOW. VAW also offers exposure to DuPont (DD), Monsanto (MON), and Praxair (PX), which have weights of 8.5%, 6.0%, and 4.4%, respectively, as of July 27, 2017.

In the next part, we’ll look into the performance of the infrastructure solutions segment in 2Q17.