Great Ajax’s Dividend Performance

Great Ajax (AJX) has recorded a dividend yield of 3.8% and total returns of 14.3% on a year-to-date basis.

July 26 2017, Published 12:10 p.m. ET

Great Ajax’s dividend performance

Great Ajax (AJX) paid 60.0% of its earnings as dividends in 2016 compared to 54.3% in 1Q17. Its first dividend was declared on May 5, 2015. The quarterly dividend payer has recorded consistent growth in its dividend rate per share since its February 2015 IPO.

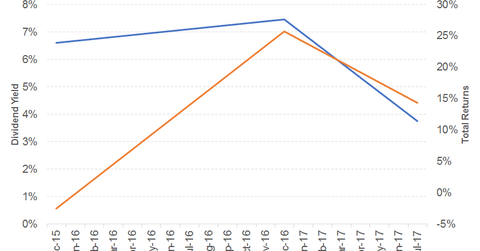

AJX recorded an average dividend yield of 7.0% and average total returns of 11.6% between February 2015 and February 2016. Great Ajax has recorded a dividend yield of 3.8% and total returns of 14.3% on a YTD basis.

Fundamentals

Great Ajax (AJX) is engaged in the acquisition, investment, and management of a portfolio of residential mortgage and small-balance commercial mortgage loans. It is also a holder of real estate–owned properties.

Great Ajax recorded 19% growth in 2016, and it recorded a growth rate of 25% in 1Q17 compared to 4Q16. It recorded a growth rate of 19% in 1Q17 compared to 1Q16. This growth was driven by its interest income.

AJX recorded a decline of 2% in its EPS (earnings per share) for 2016. Its EPS for 1Q17 has fallen 8% compared to 1Q16. The decline was driven by a higher number of weighted average shares.

AJX succeeded in recording FFO (funds from operations) growth in 2016 after huge negative growth in 2015. It has low financial leverage compared to the above REITs. AJX’s price-to-earnings multiple of 8.9x compares to the sector average of 19.2x. A dividend yield of 7.9% compares to the sector average of 9.9%.