Recommendations for Panera: Why Analysts Favor a ‘Buy’

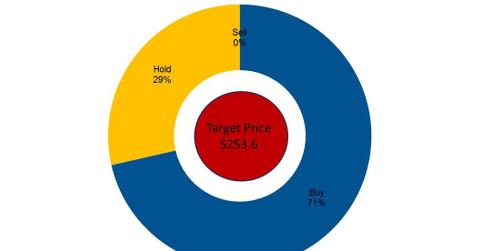

Of the 28 analysts covering Panera (PNRA), 71.4% have given it a “buy” recommendation, and 28.6% have given it a “hold.”

March 28 2017, Updated 10:38 a.m. ET

Analysts’ target prices

On March 24, 2017, Panera Bread (PNRA) was trading at $249.48. That price may have already factored in the estimates we’ve looked at in this series. In this final part of the series, we’ll look at analysts’ recommendations and the estimated target price for PNRA stock over the next 12 months.

Panera’s better-than-expected 4Q16 earnings and measures adopted by the company to increase sales appear to have prompted analysts to raise their price targets for the next 12 months. As of March 24, 2017, they’re expecting Panera stock to reach $253.64, which represents a return potential of 1.7%. Before PNRA’s 4Q16 earnings announcement, analysts had forecast a target price of $237.70.

Below are the 12-month price targets for two of Panera’s peers:

Analyst recommendations

Of the 28 analysts covering Panera (PNRA) stock, 71.4% have given it a “buy” recommendation, and 28.6% have given it a “hold.” None of the analysts have recommended a “sell.” Remember, Panera stock typically moves in tandem with analyst recommendations. As analysts raise their target prices for the next 12 months, PNRA stock should also rise, and vice versa.

Keep in mind that although Panera stock is lower than its target price, that doesn’t make it an automatic “buy.” Before deciding whether to invest, you should carefully analyze the various elements we’ve covered in this series.