Puerto Rico Records Largest Bankruptcy among US Municipalities

Despite its bankruptcy filing, Puerto Rico has the option to negotiate with its creditors outside the court. It could go through a process equivalent to a Chapter 9 bankruptcy filing.

May 8 2017, Updated 4:35 p.m. ET

Puerto Rico’s bankruptcy

Despite its bankruptcy filing, Puerto Rico (PZA) (PWZ) has the option to negotiate with its creditors outside the court. It could go through a process equivalent to a Chapter 9 bankruptcy filing. If an agreement isn’t reached with its creditors, the full $72 billion could be restructured under Title III, the Chapter 9 equivalent.

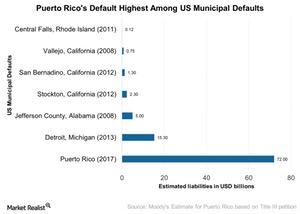

In this scenario, Puerto Rico’s bankruptcy would be nearly five times bigger than Detroit’s, which set a record in 2013. Let’s look at some of the latest US municipal defaults.

Recent US municipal bankruptcies

The chart above shows the debt amounts outstanding for some US municipalities at the times of their bankruptcies. Though Puerto Rico can’t declare bankruptcy, it has a debt of $72 billion as of 2016. Puerto Rico’s current situation shows a parallel to Detroit’s bankruptcy, which took place on July 18, 2013, and was the largest municipal bankruptcy in US history.

Both situations share certain common characteristics in terms of financial crisis. The key difference between them is the unprecedented case of Puerto Rico, which cannot file for bankruptcy under Chapter 9, unlike Detroit.

Detroit was able to file bankruptcy, while Puerto Rico, being a US territory, can’t do so, even though it may be treated like a state. Let’s look at the some of the parallels among these two large defaults:

- Detroit and Puerto Rico were both affected by falls in population, high unemployment rates, slumping real estate, and large-scale poverty.

- Both areas’ irregular financial audits and severe budget deficits adversely affected their government services.

- Both had high levels of debt, including Detroit’s long-term debt, which was estimated to be between $18 billion and $20 billion, and Puerto Rico’s ~$72 billion in public debt, which was recently downgraded to junk level by Standard & Poor’s.

Defaults

Bankruptcies followed by defaults included $1.4 million worth of pension bonds in June 2013 for Detroit and a default of nearly $1.5 billion in debt service payments by Puerto Rico in 2016. Puerto Rico has already partially defaulted on its municipal bonds, including the Puerto Rico General Obligation Bonds, Puerto Rico Public Building Authority Bonds, and Puerto Rico Infrastructure Finance Authority Bonds, to name a few.

Impact of defaults

The insurers of Puerto Rico’s debt are likely to feel the impact of insuring municipal bonds amounting to ~$12 billion of its $72 billion in debt. Some of the insurers that will face difficulties related to the debt default are Ambac Financial Group (AMBC), Assured Guaranty (AGO), and MBIA (MBI).

Some of the ETFs with exposure to junk bonds in Puerto Rico include the SPDR Nuveen S&P High Yield Municipal Bond ETF (HYMB) and the VanEck Vectors High-Yield Municipal ETF (HYD).

Let’s look at the GDP growth rate in Puerto Rico over the last few years of the recession in our next article.