The Week Ahead: Key Dates in Consumer from May 22–26, 2017

In this part of the series, we’ll look at the important events for the week ahead, from May 22–26, 2017.

Nov. 20 2020, Updated 12:33 p.m. ET

Important events in the week ahead

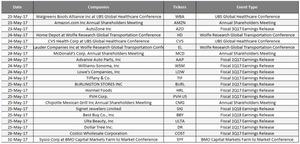

Below are the important events for the week ahead, from May 22–26, 2017. These events could positively or negatively affect the stock prices of the respective companies and the consumer-related ETFs such as the Consumer Discretionary Select Sector SPDR ETF (XLY), the SPDR S&P Retail ETF (XRT), the Consumer Staples Select Sector SPDR ETF (XLP), the Vanguard Consumer Staples ETF (VDC), the iShares Global Consumer Staples (KXI), the iShares US Consumer Goods (IYK), and the iShares US Consumer Services (IYC).

Useful links

For more information, you may be interested in the following:

- Market Realist’s Consumer Discretionary page

- Market Realist’s Consumer Staples page