China’s Baby Steps to Open Its Onshore Bond Market

The opening of China’s onshore bond market (EMB) (PCY) was a gradual process that included a number of cautious measures.

Nov. 20 2020, Updated 10:53 a.m. ET

VanEck

What Steps Has China Taken to Liberalize its Domestic Bond Market?

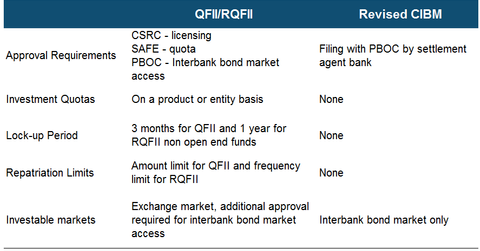

China has taken several incremental steps over the past fifteen years to open up its onshore sovereign, financial, and corporate bond markets to foreign investors. This began with the introduction of the Qualified Foreign Institutional Investors (QFII) scheme in 2002, followed by the RMB Qualified Foreign Institutional Investor (RQFII) scheme in 2011. Both allow institutional investors that meet certain qualifications to invest in onshore bonds, subject to approval as well as investment quotas, lock up periods, and repatriation limits. Since 2012, investors accessing markets through these programs could access both the exchange bond market as well as the much larger and more liquid interbank bond market, subject to additional approvals.

Market Realist

China’s efforts to open its bond market

The opening of China’s onshore bond market (EMLC) (EMAG) (IGEM) (PCY) was a gradual process that included a number of cautious measures. The entire process can be divided broadly into the following three stages:

- In the first phase that spanned 2005–2010, the process of opening the onshore bond market (LEMB) (EMLC) was initiated to a limited extent. Some of the institutions such as Asian debt funds and the Asia Debt China Fund were allowed to operate in the market. In August 2010, foreign central banks and Hong Kong–based and Macau-based RMB (renminbi) settlement banks were also allowed under a pilot scheme.

- In the second phase (2011–2015), the market was opened further with the granting of access to Hong Kong–based, Singapore-based, and Taiwan-based insurance companies as well as Hong Kong–based subsidiaries of Chinese fund management and securities companies. Although market access was granted, it was replete with many restrictions such as approval requirements from the People’s Bank of China, investment quotas such as the QFII (Qualified Foreign Institutional Investor) and RMB QFII quota schemes, repatriation limits, lockup periods, and investable market limits. Major investors during this phase included Chinese commercial banks, mutual funds, and insurance companies. Commercial banks hold the majority of government bonds (VWOB), while local mutual funds were the major investors in enterprise bonds and medium-term notes.

- In the third phase, the market was open to global investors. We’ll discuss that more in the next part.