Why Boeing’s Increasing Leverage May Mean Higher Risk

At the end of 4Q16, Boeing’s leverage fell to ~$10 billion as compared to $10.5 billion at the end of 3Q16 and $11 billion at the end of 2Q16.

April 20 2017, Updated 9:06 a.m. ET

Increasing leverage

Boeing operates in a highly capital-intensive industry. Technological obsolescence makes it imperative to invest in R&D (research and development) and come up with new products.

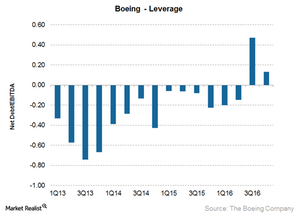

It’s no wonder then that Boeing has turned to debt to help finance its growth. At the end of 4Q16, Boeing’s leverage fell to ~$10 billion as compared to $10.5 billion at the end of 3Q16 and $11 billion at the end of 2Q16.

In 3Q16, Boeing’s debt exceeded its cash balance. As a result, its net-debt-to-EBITDA ratio rose from -0.06x at the end of 4Q15 to 0.13x at the end of 4Q16.

Among Boeing’s peers, Airbus has a lower leverage with a net-debt-to-EBITDA ratio of 19.4x, while Embraer has a net-debt-to-EBITDA ratio of 2.2x. At the end of 4Q16, Lockheed Martin (LMT) had a net-debt-to-EBITDA ratio of ~6.8x, United Technologies (UTX) had a net-debt-to-EBITDA ratio of 7.3x, and General Dynamics (GD) had a net-debt-to-EBITDA ratio of 1.3x.

Cash flows provide respite

Boeing’s cash on the balance sheet stood at $10 billion at the end of 4Q16. It also generated $10.5 billion in cash flow from operations (or CFO) in 2016 as compared to $9.4 billion in 2015. Free cash flow stood at $7.9 billion for 2016 as compared to $6.9 billion for the same period of 2015. Boeing has used some of this cash to repay debt.

Outlook for 2017

For 2017, Boeing expects its operating cash flow to increase to ~$10.8 billion. It also plans to increase manufacturing capacity to 65 aircraft a month by the end of 2017, which will require additional investments.

Some of BA’s major clients are airlines, which operate in a cyclical industry. If industry fundamentals deteriorate, it may result in order cancellations for BA, bringing its balance sheet under stress.

Investors can gain exposure to Boeing stock by investing in the ProShares Ultra Dow60 (DDM), which holds 4.5% in Boeing.