What Role Do High Yield Bonds Play in a Portfolio?

AB High Yield in the Portfolio Framework Given their higher risk levels, we’d expect that stocks would continue to outperform high yield over the long run. However, high-yield bonds have clearly demonstrated that they bring much to the table if they’re combined with stocks in a carefully designed and maintained portfolio. But not every investor […]

April 11 2017, Updated 7:37 a.m. ET

AB

High Yield in the Portfolio Framework

Given their higher risk levels, we’d expect that stocks would continue to outperform high yield over the long run. However, high-yield bonds have clearly demonstrated that they bring much to the table if they’re combined with stocks in a carefully designed and maintained portfolio.

But not every investor will be comfortable with 50%, or even 25%, of equity exposure allocated to high-yield bonds. Investors must define a portfolio allocation that’s appropriate based on their specific goals and risk tolerances. Also, demonstrating that high-yield bonds are effective in a diversified portfolio doesn’t imply that investment grade bonds won’t be effective too.

High yield’s merits, however, should prompt investors to think twice before they stereotype it as simply another element within a portfolio’s fixed-income exposure. Many investors rely on bonds to dampen the volatility of their equity portfolios, so they’re naturally reluctant to give their investment managers too much flexibility in allocating to below investment-grade bonds. That’s because high-yield bonds are admittedly among the most volatile fixed-income asset classes. But they’ve also been much less volatile than stocks.

Market Realist

High yield exposure depends on investors’ investment objectives

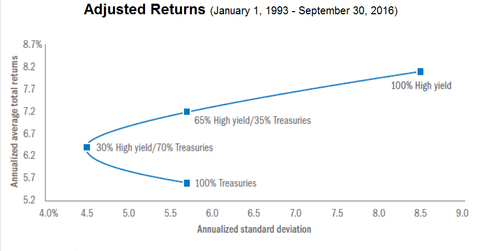

High yield bonds (HYG) (JNK) serve as an important tool to diversify a portfolio. As an asset class, high yield bonds fall between fixed-income bonds and equities on the risk band. In the previous section, we saw that returns on high yield bonds compare favorably with those of equities, while the risk is lower. Adding high yield bonds to a portfolio comprising Treasuries improves returns while controlling portfolio risk, significantly enhancing a portfolio’s risk-adjusted returns. On the other hand, a rebalanced portfolio comprising stocks and bonds helps lower portfolio volatility while mitigating downside risk.

Between January 1, 1993, and September 30, 2016, Bank of America Merrill Lynch found that a portfolio comprising 100% Treasury bonds could earn returns that are 80 basis points higher if it has a 30% exposure to high yield bonds. The rebalanced portfolio has the potential to reduce overall volatility by 1.2%. Similarly, if high yield (BKLN) (SJNK) exposure is increased from 30% to 65%, a portfolio’s excess annualized returns rise from 0.80% to 1.6%. However, the higher allocation to high yield bonds marginally boosts overall risk as well. It is clear that higher allocation to high yield bonds (HYS) enhances a portfolio’s returns while mitigating risk. However, there is no rule regarding the best allocation strategy—it depends on investors’ risk-taking ability and overall investment objectives.