Why Wall Street Is Mostly Positive on Dollar General

30 Wall Street analysts cover Dollar General (DG). On average, they rate the company a 2.4 on a scale of one (strong buy) to five (strong sell).

March 13 2017, Updated 9:06 a.m. ET

Wall Street recommendations

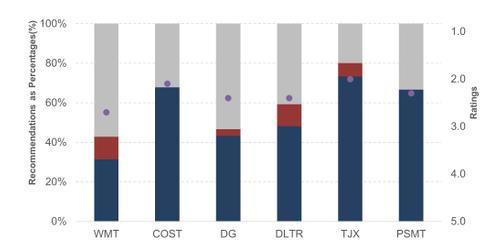

30 Wall Street analysts cover Dollar General (DG). On average, they rate the company a 2.4 on a scale of one (strong buy) to five (strong sell). Analysts appear to be positive on the company despite the recent slowdown and remain upbeat about the company’s growth prospects and fundamentals in the long run.

Competitor Dollar Tree (DLTR), which posted solid 4Q results recently, is also rated a 2.4. PriceSmart (PSMT) and TJX Companies (TJX) have better ratings of 2.3 and 2.0, respectively. Mass merchandisers Walmart (WMT) and Costco (COST) have respective ratings of 2.7 and 2.1.

Analyst actions

Dollar General was downgraded by Bank of America Merrill Lynch to a “neutral” from a “buy” rating on January 13. There haven’t been any rating changes for the company since then.

According to the most recently released broker notes, 43% of analysts have recommended a “buy” on Dollar General and 53% have set a “hold” rating. Only 3% of analysts think Dollar General is currently a sell. In comparison, 11% of analysts recommend selling Walmart and Dollar Tree.

Investors looking for exposure to Dollar General through ETFs can consider the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.2% of its total holdings in the company.

Comparing target prices and potential gains

Dollar General is currently trading at $73.63, ~32% below its 52-week high price. Analysts expect the company’s stock price to touch $79.98 over the next 12 months, which indicates an upside potential of ~9%.

Dollar Tree, Kroger (KR), and Target (TGT) have better upside potentials. The stock prices of these companies could rise 18%, 21%, and 13%, respectively, over the next year.

Read the next section to learn about Dollar General’s valuations and earnings potential.