Shandong Yuhuang Shengshi Chemical Finalizes Deal with LYB

LyondellBasell is a leading licensor of polyethylene technologies with more than 250 polyolefin process licenses.

March 20 2017, Updated 10:05 a.m. ET

Shandong Yuhuang Shengshi Chemical selects LyondellBasell

On March 13, LyondellBasell (LYB) announced that it would provide hostalen ACP polyethylene process technology for a 200 KTA high-density polyethylene (or HDPE) unit to Shandong Yuhuang Shengshi Chemical for use at its petrochemical complex at Heze in the Shandong province. The unit is expected to start in 2018. LyondellBasell is a leading licensor of polyethylene technologies with more than 250 polyolefin process licenses.

Song Juhe, vice general manager of Shandong Yuhuang Shengshi Chemical, said, “We selected the Hostalen ACP process technology for its exceptional ability to produce high-performance HDPE products and LyondellBasell’s long-term commitment to its clients.”

LyondellBasell’s stock performance for the week

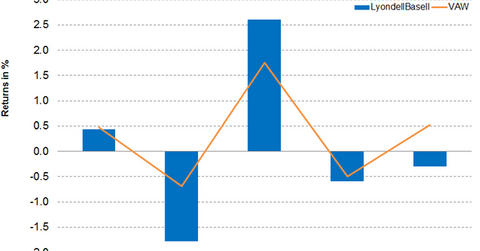

For the week ended March 17, 2017, LYB closed at $90.08 with a rise 0.3% for the week. LYB’s stock traded 1.9% above the 100-day moving average price of $88.36, indicating an upward trend in the stock. On a year-to-date basis, LYB has moved up 5.1%. LYB’s 14-day relative strength index (or RSI) of 45 indicates that the stock is neither overbought nor oversold. An RSI of 70 indicates that the stock is overbought, and a score of 30 suggests that the stock is oversold. LYB’s 52-week low is $69.82, and its 52-week high is $97.64.

LYB underperformed the Vanguard Materials ETF (VAW), which rose 1.6% for the week ended March 17, 2017. VAW invests 3.7% of its portfolio in LyondellBasell. The top holdings of the fund include Dow Chemical (DOW), DuPont (DD), and Monsanto (MON), which have weights of 8.6%, 8.4%, and 5.9%, respectively, as of March 17, 2017.