How the Mobileye Acquisition Could Impact Intel’s Earnings

Intel (INTC) is acquiring Mobileye (MBLY) for a hefty premium compared to MBLY’s earnings.

March 17 2017, Updated 6:05 p.m. ET

What Intel’s earnings could look like after the Mobileye acquisition

Intel (INTC) is acquiring Mobileye (MBLY) for a hefty premium compared to MBLY’s earnings. A $15.3 billion price tag for a business with an annual revenue of $358.0 million could be considered desperation on Intel’s part in order to make it in the autonomous car market. Its acquisition of Altera had a price tag of $16.7 billion for a business with an annual revenue of $1.5 billion.

Although the Mobileye acquisition would be immediately accretive to Intel’s earnings, it won’t make any major difference in Intel’s revenue or profits in billions of dollars.

Intel could report Mobileye’s earnings under its IoTG (Internet of Things Group), or it might create a separate automotive group. The current sizes of the two companies’ automotive businesses aren’t big enough to be separate business groups. So there’s a high probability that Intel might report Mobileye’s earnings under IoTG. That would increase IoTG’s revenue by 30.0% YoY (year-over-year) to about $3.5 billion in fiscal 2017.

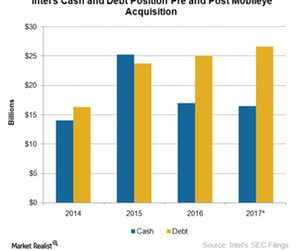

Intel’s cash and debt position after the merger

At the end of fiscal 4Q16, Intel’s cash reserves were $17.0 billion against its long-term debt of $25.1 billion. That resulted in a net debt of $12.4 billion. In fiscal 2017, Intel should receive $3.1 billion in cash from the spin-off of Intel Security, which it might use to repay $3.5 billion of debt that’s maturing in 2017. That would reduce its long-term debt to $21.6 billion.

However, according to new information, Intel has decided to use its offshore cash to fund the acquisition of Mobileye, a company based in Israel (EIS). It might have to raise new debt to fund the all-cash deal of $15.3 billion, or $14.7 billion after deducting its cash reserves.

Intel earns an annual operating cash flow of around $22.0 billion. It has committed to spend $12.0 billion in capital expenditure in fiscal 2017, leaving it with a free cash flow of $10.0 billion. It plans to spend $5.0 billion in dividend payments and might use the remaining $5.0 billion to fund the Mobileye acquisition.

Since Intel is funding 80.0% of the deal, or $11.8 billion, from its cash reserves, it would have to raise new debt of $3.0 billion. That would increase its long-term debt to $24.6 billion and reduce its cash reserves to $10.2 billion.

Next, let’s see what Mobileye is bringing to the table in the merger.