Is Teradyne fairly valued relative to its peers?

Presently, ten analysts have given Teradyne a buy rating, and four have issued a neutral rating, for a consensus target price of $22.17.

Jan. 15 2015, Updated 1:28 p.m. ET

Teradyne’s peer group

The semiconductor test is Teradyne’s (TER) primary business segment. This segment controls 50% of the market share. It has only two major competitors, Advantest Corporation (ATE) and Xcerra Corporation (XCRA).

Agilent Technologies (A) and National Instruments (NATI) compete with Teradyne in its wireless segment, but this segment contributes only a small portion of Teradyne’s total revenues. Therefore, a direct comparison is somewhat difficult.

Teradyne appears undervalued relative to its peers

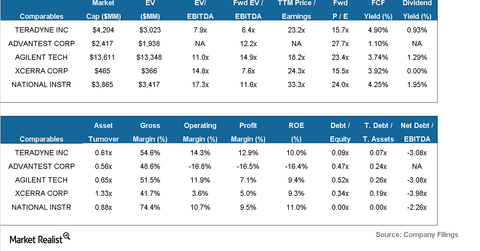

Teradyne’s gross margin of 54.6% in the last 12-month period is higher than Advantest’s (ATE) 48.6% and Xcerra’s (XCRA) 41.7%. Teradyne’s operating margin of 14.3% over the last 12-month period is also superior to its closest peers. In fact, Advantest has failed to break even in this period. Teradyne’s competitors from the wireless test segment also lag behind in terms of operating margin.

In terms of the forward PE (price-to-earnings) ratio multiple, Teradyne (TER) trades lower than Advantest (ATE) at 15.7x, and its valuation is similar to Xcerra’s (XCRA).

However, Teradyne’s forward EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) multiple of 6.4x is lower than both Advantest’s (ATE) and Xcerra’s (XCRA).

Given Teradyne’s ability to generate above-average operating profits and the favorable outlook for its semiconductor test business, it would be fair to say that Teradyne is undervalued relative to its peers.

What do the analysts recommend?

Deutsche Bank analysts reiterated a buy recommendation for Teradyne’s shares on October 24, 2014. This happened soon after Teradyne’s announcement of its third-quarter results, which beat consensus estimates. The target price of $24 reflects a 23.8% upside potential from the current market price of $19.42. Analysts at Cowen and Company reiterated an outperform rating on October 22.

On December 18, Citigroup analysts lowered their rating to neutral and set the target price at $20. They took the view that rising costs from Moore’s law scaling will not result in great benefits for automatic test equipment companies.

Presently, ten analysts have given Teradyne a buy rating, and four have issued a neutral rating, for a consensus target price of $22.17.

The positive outlook for the semiconductor equipment manufacturing industry can benefit investors in ETFs such as the VanEck Vectors Semiconductor ETF (SMH), the iShares PHLX Semiconductor ETF (SOXX), and the SPDR S&P Semiconductor ETF (XSD).