Dollar General’s Sales Comps Turn to Growth in Fiscal 4Q16

In fiscal 4Q16, Dollar General’s (DG) top line increased 13.7% year-over-year to $6 billion.

March 17 2017, Updated 9:06 a.m. ET

Dollar General beats on top line in fiscal 4Q16

As we discussed in Part 1 of this series, Dollar General (DG) reported its results for fiscal 4Q16[1. quarter ended February 3, 2017] on March 16, 2017. Dollar General’s top line increased 13.7% YoY (year-over-year) to $6 billion. The company’s top line growth was driven by strong demand for the company’s home products and consumables, which rose 11.3% YoY and 15.1% YoY, respectively, during the quarter.

The company beat Wall Street estimates by $20 million, delivering the first top line beat in fiscal 2016. In fiscal 2016, its sales increased 7.9% YoY to $22 billion.

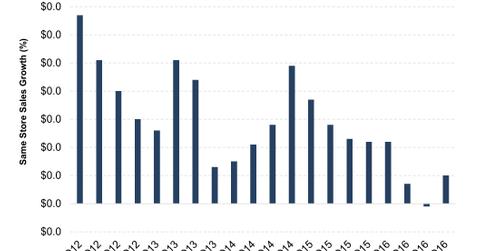

Same-store sales turn positive once again

Dollar General’s (DG) same-store sales returned to growth and improved 1% during fiscal 4Q16. The company had fumbled in fiscal 3Q16, posting a 0.1% decline in comps after reporting 36 consecutive quarters of comp growth. This improvement was driven by an increase in the company’s average transaction size, which was partially offset by a fall in traffic.

For fiscal 2016, DG’s comps rose 0.9% as the increase in transaction size was accompanied by constant traffic when compared with fiscal 2015.

How did Dollar General’s competitors fare in recent results?

Dollar General (DG), which had 7.9% top line growth in fiscal 2016, outperformed its key competitors in the discount store, supermarket, and mass-merchandising segments.

Dollar Tree (DLTR), which reported its fiscal 2016 results on March 1, recorded 5% sales growth. Walmart (WMT) and Kroger (KR) reported fiscal 2016 sales increases of 0.8% and 5%, respectively, when they reported their recent results.

Read the next section to learn about Dollar General’s 4Q16 profitability and margins.

Investors looking for exposure to Dollar General through ETFs can consider the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.2% of its holdings in the company.