Can We Build a More Environmentally Aware Portfolio?

In this highly uncertain global market, the climate change factor has taken a back seat. But we can’t ignore its effect on the economy and its financial impact.

Nov. 20 2020, Updated 12:26 p.m. ET

VanEck

Introduction

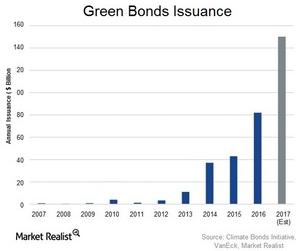

The size of the green bond market has increased significantly in recent years, with issuance nearly doubling in 2016 from 2015 levels, from $41 billion to $82 billion; 2017 issuance levels are expected to come in at approximately $150 billion. (Source: Climate Bonds Initiative) The increased demand for green bonds has come from a range of investors including institutional pension and endowment funds with environmental, social, and governance (ESG) mandates to individual investors looking to add a green focus into their fixed income allocations.

Green bonds are simply conventional bonds with an environmentally friendly use of proceeds. Today the overall market resembles a core global fixed income benchmark, with similar yield, duration, and credit quality. Investors can allocate a portion of their global bond allocation to green bonds without significantly altering the risk and return profile of their portfolio. In other words, bond investors can structure a more environmentally aware portfolio without having to compromise on their investment goals.

Although green bonds only represented about 1% of total bond issuance in 2016 (Source: Moody’s: Record Year for Green Bonds likely to Be Eclipsed Again in 2017. January 18, 2017), there is tremendous potential for continued growth. We believe that the issuance of green bonds will likely scale up massively in a short amount of time to finance the projects needed to help transition to a low carbon economy. This represents a significant opportunity for fixed income investors.

Market Realist

Climate-proofing portfolios

In this highly uncertain global market (ACWI) with populism on the rise, elections looming in Europe, and the anticipation of Fed rate hikes, the climate change factor has taken a back seat. But we can’t ignore the effects of climate-related factors on the economy and their financial impact.

As you can see in the above graph, the size of the green bond market has increased significantly in the last ten years. It’s expected to rise more in 2017. As of March 2017, Climate Bonds Initiative data show that 2017 issuance levels have reached $21.6 billion. A Reuters article stated that HSBC Bank’s preliminary estimate range for green bond issuance for 2017 is $90.0 billion–$120.0 billion, and Natixis’s estimate is $140.0 billion.

When it comes to extreme climate change, 2016 was the worst year. Climate-related risks included technological disruption and climate-related regulations. Extreme weather events have already shown their devastating effect on economies and assets. In an environmental scenario like this, green bonds appear as an evolving solution. Through green bonds, you can opt to use debt capital markets to fund climate-related projects.

Investors today are more careful about structuring their portfolios. Some are choosing to climate-proof their portfolios in order to benefit in the short term as well as the long term. You can consider the recently launched VanEck Vectors Green Bond ETF (GRNB), which gives exposure to green bonds issued to finance environmentally friendly projects. GRNB tracks the S&P Green Bond Select Index.

In this series, we’ll be looking at green bonds and the part they might play in this environment of climate change and extreme weather events.