Why Hanesbrands’ Weak Innerwear Sales Drove Its Top Line Miss

With trailing-12-month sales of over $6 billion, Hanesbrands (HBI) is one the largest marketers of basic apparel in the United States.

Feb. 7 2017, Updated 10:40 a.m. ET

Overview of HanesBrands’ 4Q16 sales

With trailing-12-month sales of over $6 billion, Hanesbrands (HBI) is one the largest marketers of basic apparel in the United States.

The company reports its business under four categories, namely: innerwear, active wear, direct-to-customer sales, and international. Innerwear and active wear together accounted for ~69% of the company’s top line in fiscal 2016.

Innerwear sales plunge on poor show from basics and hosiery

Sales from the innerwear segment fell 8% YoY (year-over-year), missing the lower end of the management’s guidance despite additional shopping days, better weather, and easy comps. Sales of basics and hosiery fell while sales of intimates remained flat. Weaker-than-expected sales from this segment were the biggest reason behind the company’s top line miss during the quarter.

Activewear sales gain strength

Activewear sales grew 3% during the quarter, driven by double-digit growth in the mass channel and the expansion into the high school channel.

International segment remains strong

International sales soared ~78% during the quarter. Growth was driven by the organic as well as inorganic route. While most of the gains came from the acquisition of Pacific Brands of Australia, Champion Japan, and Champion Europe, organic growth in Asia was also a reasonable contributor.

Challenges for DTC continue in the fourth quarter

Direct-to-consumer (or DTC) sales were down 12% YoY. As in the last couple of quarters, the current quarter’s sales were impacted by the company’s exit from its legacy catalog business. A reduction in non-core offerings, both in outlet stores and online channel, also negatively impacted sales.

Online becomes a preferable medium

Online sales accelerated 28% during the quarter. The online channel now accounts for 11% of the company’s US sales compared to 8% a year ago.

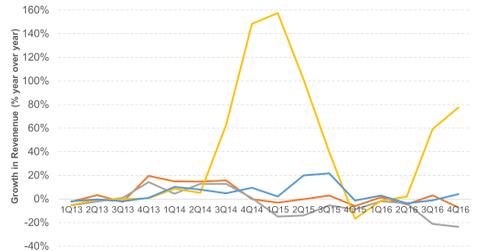

Comparing HBI’s sales growth to apparel peers

Though HBI missed revenue expectations during the quarter, its top line growth of 12% was better than most peers.

In comparison, Ralph Lauren (RL), VF Corp (VFC), and Gap (GPS) reported contraction in business in their last reported quarters. Their top lines fell 12%, 1.2%, and 1.6%, respectively.

Investors who want exposure to HBI can consider pooled investment vehicles like Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.09% of its portfolio in HBI.