Raymond James Upgrades Visteon Corporation to ‘Outperform’

VC fell 2.1% to close at $87.19 per share on January 12. Its weekly, monthly, and YTD price movements were 3.9%, 3.9%, and 8.5%, respectively.

Jan. 16 2017, Updated 9:07 a.m. ET

Price movement

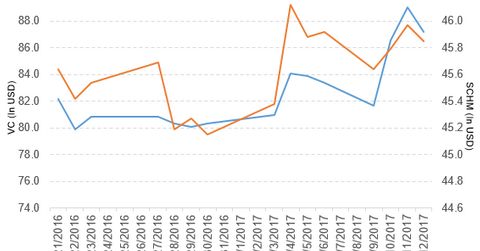

Visteon Corporation (VC) has a market cap of $3.0 billion and fell 2.1% to close at $87.19 per share on January 12, 2017. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 3.9%, 3.9%, and 8.5%, respectively, on the same day.

VC is now trading 5.7% above its 20-day moving average, 10.6% above its 50-day moving average, and 18.3% above its 200-day moving average.

Related ETF and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.10% of its holdings in Visteon. The YTD price movement of SCHM was 1.6% on January 12.

The market caps of Visteon’s competitors are as follows:

VC’s rating and performance in 3Q16

Raymond James has upgraded Visteon’s rating to “outperform” from “market perform” and has set the stock’s price target at $105.0 per share.

Visteon reported 3Q16 sales of $770.0 million—a fall of 4.7% from its sales of $808.0 million in 3Q15. The company’s gross profit margin expanded 60 basis points in 3Q16 over 3Q15.

Its net income and EPS (earnings per share) rose to $28.0 million and $0.81, respectively, in 3Q16, as compared to $5.0 million and $0.12, respectively, in 3Q15. It reported adjusted EPS of $1.10 in 3Q16—a rise of 96.4% over 3Q15.

VC’s cash and equivalents and trade receivables fell 68.8% and 5.9%, respectively, between 3Q16 and 4Q15.

Projections

Visteon has made the following projections for fiscal 2016:

- sales for the Electronics Product Group to reach $3.1 billion

- adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) for the Electronics Product Group to be in the range of $325 million–$335 million

- adjusted free cash flow for the Electronics Product Group to be in the range of $125 million–$150 million.

In the next part of this series, we’ll discuss Conagra Brands (CAG).