Can Hershey’s Margins Improve in 4Q16?

Unlike its gross margin, Hershey’s operating margin expanded to 18.7% in 3Q16 from 15.5% in 3Q15. This improvement was mainly due to a favorable comparison with 3Q15.

Jan. 30 2017, Updated 2:05 p.m. ET

Pressure on margins

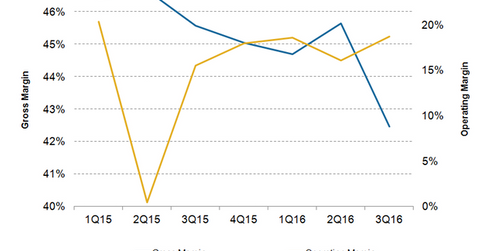

In 3Q16, The Hershey Company’s (HSY) gross margin fell 300 basis points year-over-year to 42.5%. This significant fall was mainly caused by mark-to-market losses on commodity derivative instruments and higher depreciation expenses related to business realignment activities.

Hershey’s 3Q16 gross margin was also adversely impacted by a rise in its supply chain costs and an unfavorable sales mix.

Operating margin in previous quarter

Unlike its gross margin, Hershey’s operating margin expanded to 18.7% in 3Q16 from 15.5% in 3Q15. This improvement was mainly due to a favorable comparison with 3Q15, which was impacted by a $31.0 million non-cash goodwill impairment charge related to the Shanghai Golden Monkey acquisition.

Excluding the impact of this goodwill impairment charge, the company’s 3Q16 operating margin expanded 170 basis points, driven by lower selling, advertising, and marketing costs and lower business realignment charges.

The operating margin of Mondelēz International (MDLZ) in 3Q16 was 11.0%, compared to 113.9% in 3Q15. MDLZ’s higher operating margin in 3Q15 was mainly due to a pre-tax gain on its JDE coffee business transaction.

Hershey’s and Mondelēz form a combined 2.5% of the iShares Global Consumer Staples ETF (KXI).

Margin expectations

Hershey expects its gross margin in 2016 to contract slightly compared to the previous year. The company’s productivity initiatives are expected to drive cost savings of $135 million in 2016 and at least $100 million in 2017 through 2019.

In the next part of this series, we’ll discuss Hershey’s earnings expectations.