Bank of America Merrill Lynch Downgrades AptarGroup

AptarGroup (ATR) has a market cap of $4.6 billion. It fell 0.43% to close at $73.48 per share on December 7, 2016.

Dec. 8 2016, Updated 3:35 p.m. ET

Price movement

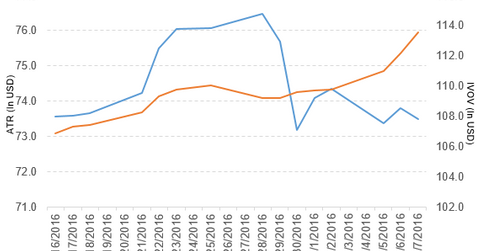

AptarGroup (ATR) has a market cap of $4.6 billion. It fell 0.43% to close at $73.48 per share on December 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.41%, -1.1%, and 2.8%, respectively, on the same day.

ATR is trading 1.0% below its 20-day moving average, 1.7% below its 50-day moving average, and 3.8% below its 200-day moving average.

Related ETF and peers

The Vanguard S&P Mid-Cap 400 Value ETF (IVOV) invests 0.27% of its holdings in AptarGroup. The YTD price movement of IVOV was 28.4% on December 7.

The market caps of AptarGroup’s competitors are as follows:

ATR’s rating

On December 7, 2016, Bank of America Merrill Lynch downgraded AptarGroup’s rating to “underperform” from “buy.”

Performance of AptarGroup in 3Q16

AptarGroup reported 3Q16 net sales of $589.7 million, a rise of 0.58% compared to $586.3 million in 3Q15. The company’s operating income narrowed 100 basis points in 3Q16 compared to 3Q15.

ATR’s net income and EPS (earnings per share) fell to $53.1 million and $0.82, respectively, in 3Q16, compared to $53.2 million and $0.83, respectively, in 3Q15. It reported adjusted EPS of $0.82 in both 3Q16 and 3Q15.

AptarGroup’s cash and cash equivalents fell 11.7%, and its inventories rose 9.2% between 4Q15 and 3Q16.

The company expects EPS of $0.63–$0.68 for fiscal 4Q16, excluding the impact of the timing of costs incurred and any insurance-related reimbursements from the fire in its facility at Annecy, France.

Next, we’ll look at Graphic Packaging Holding (GPK).