What Does the MLP Funds Market Look Like?

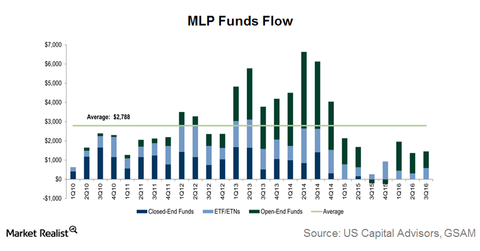

MLP funds’ capital inflows have recovered slightly in 2016 compared to 2H15. However, their overall capital inflow is still lower than their seven-year average.

Nov. 30 2016, Updated 8:04 a.m. ET

MLP funds: A market overview

MLP funds’ capital inflows have recovered slightly in 2016 compared to their levels during 2H15. However, their overall capital inflow is still lower than their seven-year average of ~$2.8 billion.

Open-ended funds

Open-ended funds’ share of total capital inflow is higher compared to exchange-traded products such as ETFs and ETNs. The advantage of open-ended funds is active management.

In the current volatile commodity price environment, active management should be preferable to the passive strategies of exchange-traded products. However, active management comes with a price: higher expenses. These expenses bring down funds’ overall returns. The effect is magnified when MLPs aren’t doing well.

Exchange-traded products

Open-ended funds are followed by passively managed exchange-traded products in terms of MLP fund flows. These passively managed products include ETFs and ETNs. ETFs and ETNs track the performances of MLP indexes. MLP ETNs currently make up 35% of all US ETNs by market cap.

ETNs are similar to ETFs, but they’re structured differently. They’re structured as debt securities issued by underwriting banks. ETNs have maturity dates and are backed by the credit of the issuer, meaning that they have credit risk in addition to market risk. Two of the most well-known MLP ETFs and ETNs are the Alerian MLP Index (AMLP) and the JPMorgan Alerian MLP Index ETN (AMJ). Enterprise Product Partners (EPD) and Energy Transfer Partners (ETP) are the top holdings of AMLP and AMJ.

ETFs, mutual funds, and ETNs

Among MLP funds, ETNs are the top performers in terms of total returns. Open-ended funds’ underperformance relative to ETFs is most likely due to their higher expenses. An MLP ETF and an ETN tracking the same index still differ in performance due to different tax consequences.

MLP ETFs are generally structured as C corporations, which means they have to pay corporate taxes on distributions before those distributions are passed on to investors. This requirement results in differences in the performances of MLP ETFs and their underlying MLPs.

In comparison, ETNs don’t pay any taxes on distributions, resulting in better performance-tracking with their MLP indexes. However, their distributions are treated as taxable income. Investors can avoid these tax consequences or tracking errors by investing directly into MLPs. However, doing so would mean investors have to undergo the complicated process of filling out K-1 forms.