What Are the Methods Used to Tackle ESG Issues?

There are some important things to know when analyzing ESG issues. Unlike traditional analysis, there’s no particular outlined method for conducting ESG analysis.

Nov. 20 2020, Updated 2:19 p.m. ET

Analysis of ESG issues

ESG (environmental, social, and governance) issues have gained some prominence in terms of evaluating investments. The analysis of ESG issues is not a standalone. It complements traditional financial analysis by including ESG issues, whose details we’ve discussed in previous articles in this series.

There are some important things to know when analyzing ESG issues. Unlike traditional analysis, there’s no particular outlined method for conducting ESG analysis. Also, the importance of ESG varies considerably across sectors. Though governance issues are not so varied, issues related to the environment can be very different across sectors. For instance, the environmental impact of the operations of a financial research company will be drastically different from one operating in the oil and gas industry.

There can be different reasons for analyzing ESG issues in light of socially responsible investing. Some can be the outcomes of a change in the regulatory framework that applies to companies in a certain industry, forcing them to do what’s necessary. The analysis can also be driven by the desire to impact the environment in a favorable manner or follow company or individual values and ethics. Some investors even feel that analyzing ESG issues can provide them with an edge over other investors by investing in companies that can outperform the market in the long term.

Methods to tackle ESG issues when investing

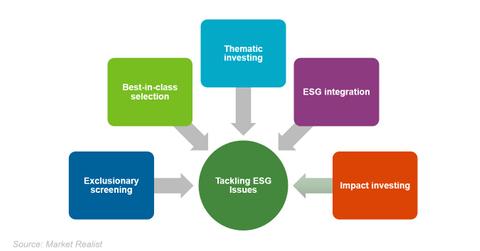

The following methods are adopted by analysts and investors in tackling ESG issues:

Exclusionary screening: This method completely avoids stocks or even geographies based on ethical and moral issues or norms. For instance, Islamic investing doesn’t allow investment into companies operating in the alcohol, tobacco, gambling, or pork businesses.

Best-in-class selection: Unlike exclusionary screening, this method doesn’t put a blanket ban on a particular industry or business. It looks for the best companies in a given sector, given the analysis of ESG issues. For instance, this method will not ban an investment vehicle from investing in fossil fuels. Instead, it will select the companies with the best ESG metrics.

Thematic investing: This method invests in emerging trends. For instance, there’s a fund based on water conservation.

ESG integration: This method is responsible investment, which we looked at earlier in this series. Instead of evaluating ESG issues separately from traditional financial analysis, it explicitly includes these issues as opportunities or threats when conducting analyses.

Impact investing: This method is followed by a few funds that explicitly disclose their intent to generate and measure social and environmental benefits alongside financial returns.

A few ETFs that can help you invest responsibly are the EcoLogical Strategy ETF (HECO), the iShares Global Clean Energy ETF (ICLN), the PowerShares Cleantech ETF (PZD), the Global X Conscious Companies ETF (KRMA), and the Columbia Sustainable U.S. Equity Income ETF (ESGS).

In 2015, the Obama administration passed a bill that was of great benefit to renewable energy. Let’s look at that in the next article.