What to Take from the Enhanced Analytics Initiative

The onValues report on behalf of the Enhanced Analytics Initiative made several conclusions regarding the progress of its understanding of environmental, social, and governance criteria.

Nov. 20 2020, Updated 10:54 a.m. ET

Enhanced Analytics Initiative evaluations

The onValues report on behalf of the Enhanced Analytics Initiative, published in December 2008, concluded the following on the progress of its understanding of ESG (environmental, social, and governance) criteria:

- Environmental issues (PHO) (GEX) saw the highest growth in quantity and quality of research, particularly where the driver was easily quantifiable (for example, emissions trading costs under the European Union Emission Trading Scheme) or where there was a strong opportunity story (such as clean technology).

- Research on governance issues progressed to some degree in both quantity and quality, though there was a general belief that these issues were under-covered to a large degree, given that corporate disclosure on governance is often relatively good.

- Coverage of material social issues (RODI) was very patchy. There was some analysis on human and intellectual assets after repeated requests, but other issues weren’t covered in any depth.

Dominant ESG issues

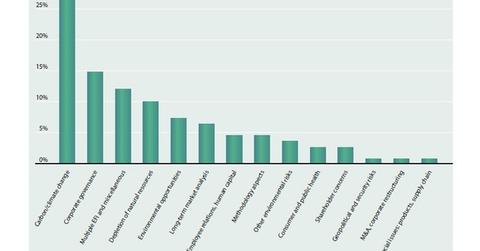

The evaluations mentioned above are reflected in the graph above. In the Enhanced Analytics Initiative evaluation, environmental issues dominated. Carbon emissions and climate change, natural resources depletion, and environmental opportunities dominated the issues that were researched by asset owners and managers.

Conclusions of the Enhanced Analytics Initiative

The onValues report concluded the following from the initiative:

- High-quality research drives better investment decisions.

- Extra financial issues are a component of high-quality research.

- Quality research requires adequate resourcing.

- Investors must articulate their needs.

- Good research demands broader market usage.

- Integration is a challenge, but the challenge can be met.

With the background drawn up in this article and the previous one, let’s look at the methodologies that are used to tackle ESG issues (GIVE) (FLAG) in the next article.