Kohl’s Valuation Surges after Fiscal 2Q16 Results

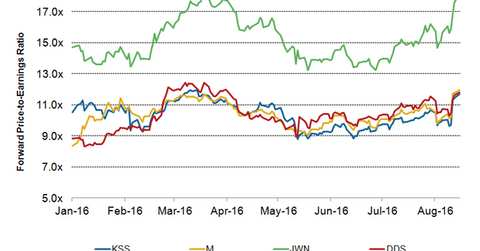

As of August 15, Kohl’s was trading at a 12-month forward PE (price-to-earnings) ratio of 11.7x.

Nov. 20 2020, Updated 12:20 p.m. ET

Current valuation

As of August 15, Kohl’s was trading at a 12-month forward PE (price-to-earnings) ratio of 11.7x. Kohl’s valuation multiple rose by 16.4% on August 11, the day the company announced its results for 2Q16. As discussed in parts two and three of this series, Kohl’s exceeded the analysts’ earnings and sales estimates for 2Q16. However, the company lowered its adjusted EPS guidance for fiscal 2016 due to weak sales expectations.

Comparison with peers

Kohl’s valuation multiple is currently lower than its department store peers. As of August 15, Macy’s (M), Nordstrom (JWN), and Dillard’s (DDS) were trading at 12-month forward PEs of 11.9x, 18.1x, and 11.8x, respectively. The iShares Global Consumer Discretionary ETF (RXI) has 0.2% exposure to Kohl’s.

The S&P 500 Consumer Discretionary Index and the S&P 500 Index were trading at 12-month forward PEs of 18.1x and 17.6x, respectively, as of August 15.

The forward PE multiple is influenced by several factors, including earnings growth rate and risks and uncertainties. Currently, analysts expect Kohl’s sales and adjusted EPS (earnings per share) to decline by 2% and 3%, respectively, in fiscal 2016. The adjusted EPS excludes the impact of non-recurring items.

Analysts expect fiscal 2016 adjusted EPS of Macy’s, Nordstrom, and Dillard’s to fall by 11%, 18%, and 12%, respectively. JCPenney (JCP) is expected to deliver adjusted EPS of $0.15 in fiscal 2016 compared to -$1.03 in fiscal 2015, driven by its turnaround efforts.

Growth strategy

Kohl’s is trying to boost its sales through various strategies, including focusing on attractive merchandise categories like its active and wellness categories. The company is also enhancing its online infrastructure to boost its e-commerce sales. The company is also working on new store formats. In March, the company opened two additional Off-Aisle stores, bringing the total count to three. Kohl’s also opened 12 FILA outlet stores in May. The company also plans to open six smaller-format stores in 3Q16, in addition to the two 35,000-square-foot smaller stores opened in 1Q16. These smaller store formats are likely to help the company in improving its productivity.

As of the end of 2Q16, the company operated 1,150 Kohl’s stores, 12 FILA outlet stores, and three Off-Aisle clearance centers in 49 states.

For more industry updates, visit our Department Stores page.