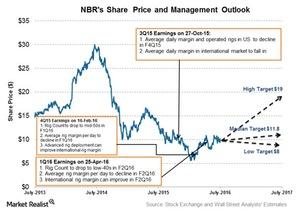

What Is Nabors Industries’s Management Outlook for 2Q16?

Nabors Industries’s (NBR) management expects the crude oil market to start recovering in 2017. The recovery is expected to benefit the high-performance rigs first.

July 21 2016, Updated 3:06 a.m. ET

What does Nabors Industries’s CEO think?

Nabors Industries’s (NBR) management expects the crude oil market to start recovering in 2017. The recovery is expected to benefit the high-performance rigs first.

In the company’s 1Q16 earnings conference call, Nabors Industries’s chairman and CEO, Anthony Petrello, commented, “Signs of an emerging supply demand balance in the oil market are beginning to emerge. While we do not yet see tangible evidence of the recovery and activity, we are beginning to correct the anecdotes, which could point to the recovery late this year going into 2017.

“We believe the recovery will be modest initially and could accelerate as commodity markets rebalance. We expect demand for high performance rigs to increase at first and for pricing that segment to react accordingly.”

By comparison, Oil States International’s (OIS) management thinks the industry’s exploration and production spending will be lower in 2016, while offshore projects will be deferred. NBR comprises 0.15% of the ProShares Ultra MidCap400 ETF (MVV).

Nabors Industries on pricing pressure

Nabors Industries’s management expects that pricing pressure will ease in the international market when the energy market recovery starts.

Petrello commented, “We expect demand for high performance rigs to increase at first and for pricing that segment to react accordingly. As well we would expect the restoration of temporary pricing concessions agreed to with our international customers.”

You can read more about this topic in Will Nabors Industries Overcome Its Short-Term Challenges?

Next, we will discuss short interests for NBR.