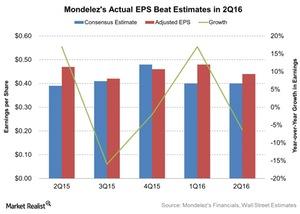

Did Mondelez’s Earnings Manage to Beat Estimates in 2Q16?

Mondelez exceeded analysts’ earnings estimates of $0.40 by 10% for 2Q16. The adjusted EPS (earnings per share) was ~$0.44 for the quarter.

Aug. 2 2016, Updated 11:04 a.m. ET

Earnings beat estimates

Mondelez (MDLZ) has been surpassing analysts’ estimates for the past nine quarters except 4Q15. It continued the trend and exceeded analysts’ earnings estimates of $0.40 by 10% for 2Q16. The adjusted EPS (earnings per share) was ~$0.44 for the quarter. However, it fell 6% compared to EPS of $0.47 in 2Q15. On a constant-currency basis, the EPS grew by 4.5%. Growth in the operating profit drove the earnings increase. It also included the impact of coffee dilution.

For 1H16, on a constant currency basis, the adjusted EPS grew by 17%. Operating gains of $0.15 contributed to the growth.

Management’s view

Irene Rosenfeld, Mondelez’s chairman and CEO stated that “Despite a challenging macro environment, our strong execution and first-half performance give us confidence in delivering our 2016 outlook and 2018 margin targets. While our reported margin results reflect the negative impact from the loss of revenue from our coffee joint venture and Venezuela deconsolidation, we continue to drive strong margin expansion on an adjusted basis.”

She added that “Our ongoing focus on operational efficiency enables us to invest for sustainable, profitable growth in our Power Brands, white-space expansion and sales capabilities. This is evidenced by our upcoming launch of Milka chocolate in China, a $2.8 billion market with significant growth potential, and our substantial investment in e-commerce.”

Peers’ earnings

Mondelez’s peers in the industry include Campbell Soup (CPB), ConAgra Foods (CAG), and Pinnacle Foods (PF). Campbell and Pinnacle reported earnings growth of 5% and 3%, while ConAgra reported falling earnings of 12%.

To gain exposure to Mondelez, you can invest in the First Trust NASDAQ-100 Ex-Technology Sector IndexSMFund (QQXT) and the First Trust NASDAQ-100 Equal Weighted IndexSMFund (QQEW). They invest 3% of their combined holdings in the stock.