Can Walmart Deliver Operating Margin Expansion amid Headwinds?

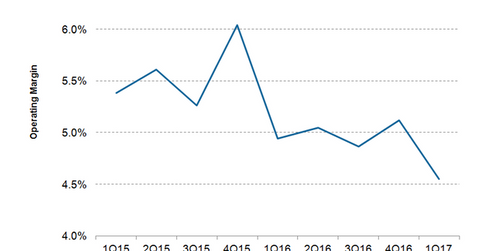

In fiscal 1Q17, Walmart’s operating margin declined by about 40 basis points to 4.6% mainly due to a rise in expenses associated with the planned wage rate increase in the Walmart US and Sam’s Club segments.

July 22 2016, Updated 1:09 p.m. ET

Why margins are under pressure

Walmart’s operating margin has been under pressure due to higher expenses, primarily resulting from the planned wage increases. Also, growth investments, including investments to enhance the company’s digital capabilities, have been adversely impacting the company’s margins.

Margins in fiscal 1Q17

In fiscal 1Q17, Walmart’s gross margin increased by 60 basis points to 24.7%, driven by the following factors:

- higher margins in the grocery and health and wellness businesses in the Walmart US segment

- improved inventory management and cost-saving initiatives in certain markets in the Walmart International segment

- a reduction in low-margin fuel sales in the Sam’s Club segment

However, Walmart’s operating margin declined by about 40 basis points to 4.6% mainly due to a rise in expenses associated with the planned wage rate increase in the Walmart US and Sam’s Club segments. The 1Q17 operating margin was also impacted by the company’s continued investments in digital retail and information technology. Walmart constitutes 1.2% of the iShares Global 100 ETF (IOO).

Walmart’s peers Target (TGT) and Kroger (KR) delivered operating margins of 8.1% and 3.5%, respectively, in their comparable first quarters. Costco Wholesale (COST) generated an operating margin of 3.2% in fiscal 3Q16, which ended on May 8, 2016.

Focus on cost reduction

Walmart is focused on improving its margins by reducing costs associated with business operations and merchandise procurement. The company has been optimizing its retail footprint by closing unprofitable stores in the United States and in international markets.

Walmart is also working on enhancing its margins in its international markets such as the United Kingdom, which is facing fierce competition. In the 1Q17 conference call, Brett Biggs, Walmart’s CFO (chief financial officer), stated that the company is making continued progress on its cost analytics program in the United Kingdom and China. The cost analytics program is a part of the company’s Project Renewal turnaround plan. It provides merchants with tools and cost visibility to lead fact-based negotiations with suppliers. In the fiscal 1Q17 conference call, Walmart’s CFO stated that the company is expanding the cost analytics program beyond the United Kingdom and Canada to Mexico in 2Q17 and other markets in 3Q17 and 4Q17.

We’ll discuss analysts’ recommendations for Walmart’s stock in the next part of this series.