SSE Composite Index Rose ahead of Long Weekend

The SSE Composite Index rose slightly by 0.4% to 2,927.16 from June 1 to June 8, 2016, as the market prepared for the long weekend.

June 10 2016, Updated 3:39 p.m. ET

Shanghai Stock Exchange (SSE) Composite Index rose marginally

The SSE Composite Index rose slightly by 0.4% to 2,927.16 from June 1 to June 8, 2016, as the market prepared for the long holiday weekend. China’s stock markets will be closed on Thursday and Friday for the Dragon Boat weekend holiday. The market retreated due to better-than-expected imports data, which signalled an improvement in China’s domestic demand and recovery of the economy. Moreover, market participants are speculating about the possible inclusion of China’s A-shares in MSCI’s emerging market indexes next week, which would have a positive impact on the stock market.

Meanwhile, according to a report published by World Bank on June 8, it had kept China’s 2016 growth forecast at 6.8%, unchanged from its previous estimates. However, the organization warned that the growth could dip to 6.3% by 2018 as China transitions towards a more consumer and services-driven economy.

The SSE Composite Index includes all listed stocks (A shares and B shares) at Shanghai and Shenzhen Stock exchanges. A-shares are shares denominated in domestic currency and are available only to local investors. On the other hand, B-shares are shares denominated in foreign currency such as in US dollars on the Shanghai Stock Exchange and in Hong Kong dollars on the Shenzhen Stock Exchange and are available to foreign investors.

China announced investment quota for the US

In the latest development, vice-governor of the People’s Bank of China (or PBOC), Yi Gang, at the bilateral Strategic and Economic Dialogue talks in Beijing announced that China will give the US a quota of 250 billion yuan ($38 billion) in the Renminbi Qualified Foreign Institutional Investor (or RQFII) for the first time to buy Chinese stocks, bonds, and other assets. China has given such quota allocations to several countries like the UK, France, and Singapore, but this will be the biggest quota given to a single jurisdiction after Hong Kong.

This move would enable the yuan to become a widely used global currency while giving US institutional investors greater access to Chinese financial markets. However, the implementation would largely depend on how much US investors are interested in buying Chinese stocks and bonds.

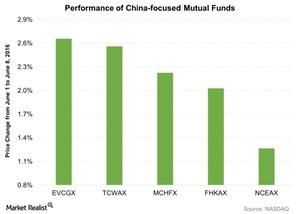

Returns on China-focused funds

From June 1 to June 8, 2016, the Eaton Vance Greater China Growth Fund – Class A (EVCGX) was up 2.7%.

The Templeton China World Fund (TCWAX), the Matthews China Fund – Investor Class (MCHFX), and the Fidelity Advisor China Region Fund – Class A (FHKAX) rose 2.6%, 2.2%, and 2.0%, respectively.

Meanwhile, the Neuberger Berman Greater China Equity – Fund Class A (NCEAX) rose 1.3% for the same period. The Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (ASHR) and the iShares MSCI China ETF (MCHI) were up 0.5% and 2.7%, respectively.

From June 1 to June 8, 2016, the American depository receipts (or ADRs) of JD.Com (JD), 58.Com (WUBA), and Baidu (BIDU) were down by 10.7%, 7.3%, and 4.4%, respectively.

In the next article, we’ll look at China’s export and import data.